First Trust NASDAQ Technology Div ETF

Latest First Trust NASDAQ Technology Div ETF News and Updates

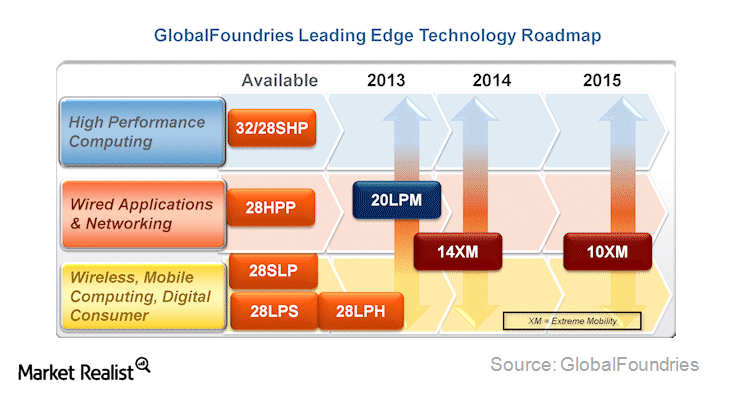

Why IBM sold its semiconductor division to Globalfoundries

In its 3Q14 results, IBM (IBM) announced the sale of its semiconductor operations to Globalfoundries. IBM will pay Globalfoundries $1.5 billion over next three years.

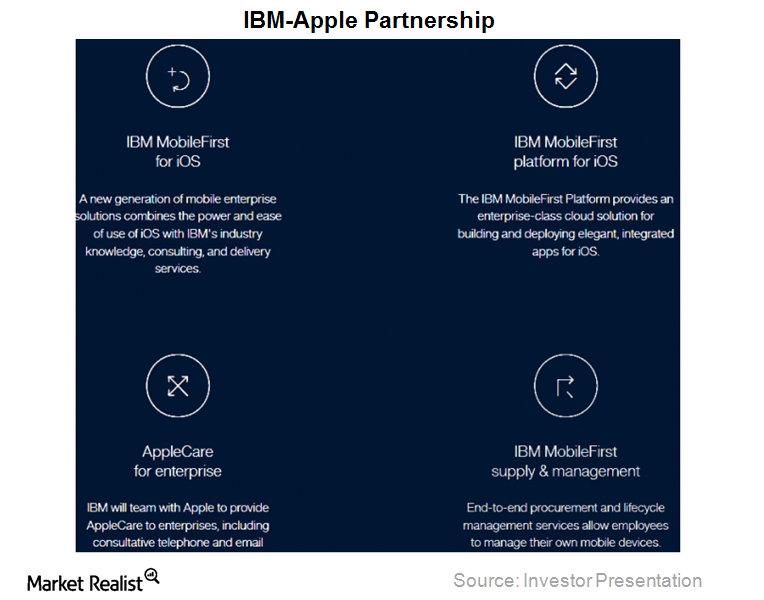

Why IBM announced a partnership with Apple

In July 2014, IBM Corp. (IBM) announced its partnership with Apple Inc. (AAPL). IBM wants to make a space for itself in the enterprise mobility space.

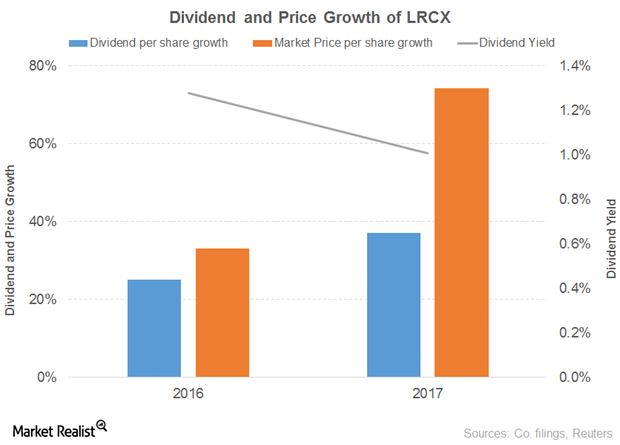

What’s Contributing to Promising Outlook for Lam Research?

Lam Research’s (LRCX) revenue rose 12% and 36% in 2016 and 2017, respectively. It rose 52% in 1Q18.

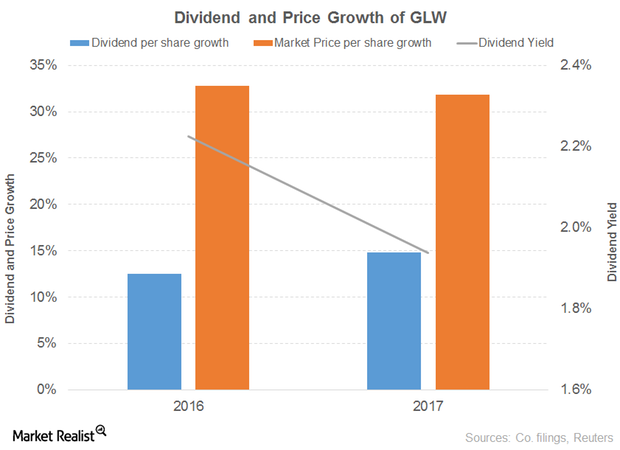

What Are Corning’s Key Growth Drivers?

Corning’s gross margin grew 3% and 9% in 2016 and 9M17, respectively.

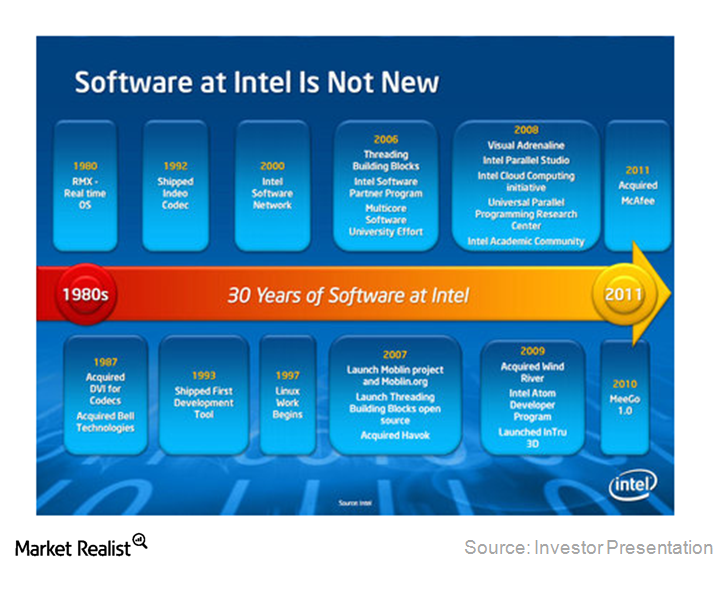

Must-know: Intel’s software and services strategy

In accordance with its mobile strategy in 2010, Intel acquired McAfee for ~ $7.7 billion. Intel acquired McAfee with the intent of integrating its security solutions into Intel-manufactured chips.