Corning, Inc.

Latest Corning, Inc. News and Updates

Here’s Apple’s Answer to iPhone Demand Problem

Apple is considering pricing the iPhone in local currency outside the United States.

What Are Corning’s Key Growth Drivers?

Corning’s gross margin grew 3% and 9% in 2016 and 9M17, respectively.

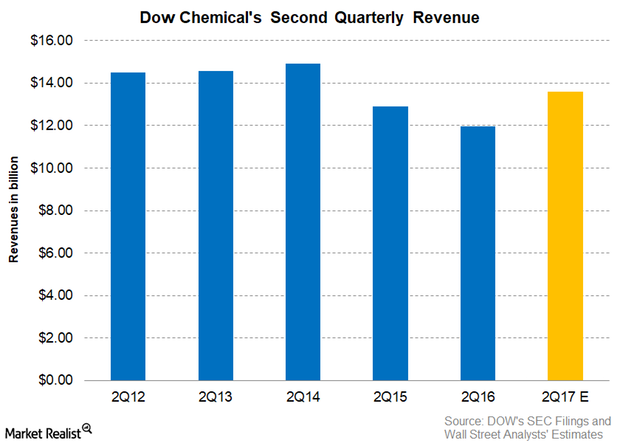

Understanding DOW’s High 2Q17 Revenue Hopes

As of July 21, 2017, analysts are expecting Dow Chemical (DOW) to post revenues of ~$13.6 billion for 2Q17, which would represent a 14.0% rise on a YoY basis.

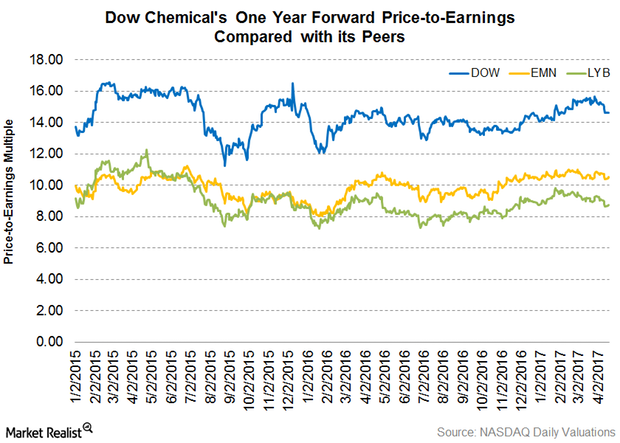

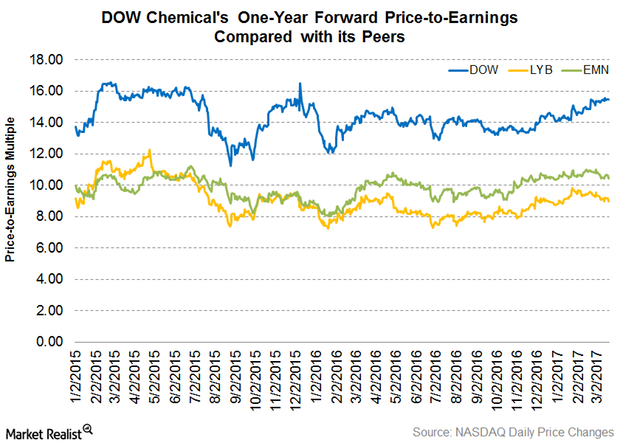

Dow Chemical’s Latest Valuations Post 1Q17 Earnings

As of April 27, 2017, Dow Chemical (DOW) was trading at a one-year forward PE ratio of 15.4x, compared to Eastman Chemical (EMN) and LyondellBasell (LYB) at 10.9x and 8.9x, respectively.

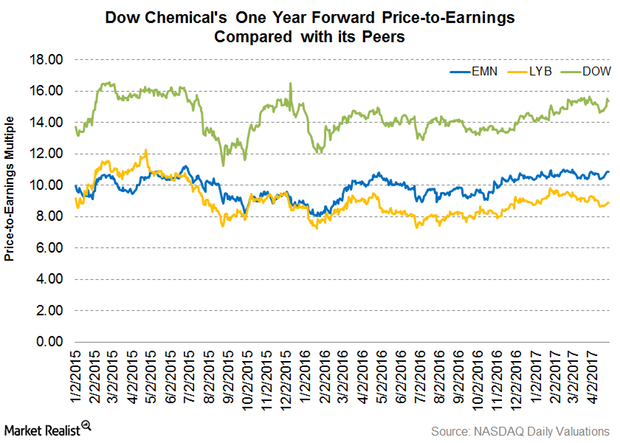

What Are Dow Chemical’s Valuations ahead of 1Q17 Earnings?

As of April 19, 2017, Dow Chemical (DOW) traded at a one-year forward PE ratio of 14.60x.

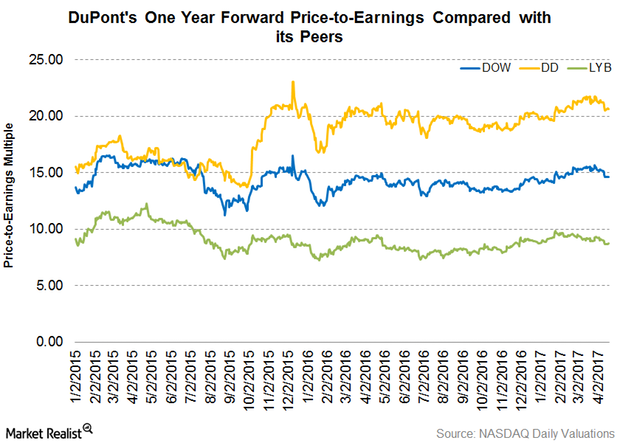

Why DuPont Trades at a Premium to Its Peers

As of April 18, 2017, DD traded at a one-year forward PE multiple of 20.60x.

Dow Chemical Trades at a Premium to Its Peers

As of March 21, Dow Chemical (DOW) traded at a one-year forward PE multiple of 15.50x—compared to its peers Eastman Chemical and LyondellBasell.