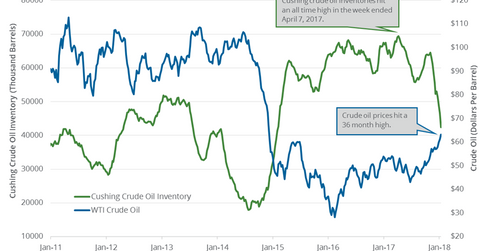

Cushing Inventories Hit January 2015 Low

A Bloomberg survey estimates that the crude oil inventories at Cushing could have declined by 2.3 MMbbls (million barrels) on January 12–19, 2018.

Nov. 20 2020, Updated 1:18 p.m. ET

Cushing inventories

A Bloomberg survey estimates that the crude oil inventories at Cushing could have declined by 2.3 MMbbls (million barrels) on January 12–19, 2018. The EIA will release its crude oil inventories report on January 24, 2018.

Any decrease in Cushing inventories has a positive impact on oil (USO) (SCO) prices. WTI oil (DBO) prices are near a three-year high. It favors funds like the Vanguard Energy ETF (VDE), which has exposure to US energy stocks.

Inventories for the week ending January 12

According to the EIA, Cushing inventories declined by 4,184,000 barrels or 9% to 42.2 MMbbls on January 5–12, 2018. It was a record weekly decline in Cushing inventories. Inventories declined by 25,115,000 barrels or 30% YoY (year-over-year).

Any decline in the inventories favors oil (UCO) prices. Higher oil (SCO) prices support energy producers’ (VDE) (XLE) earnings like Bill Barrett (BBG), Stone Energy (SGY), and Whiting Petroleum (WLL).

EIA’s US crude oil inventories

US crude oil inventories declined by 6.9 MMbbls to 412.7 MMbbls on January 5–12, 2018. They also dropped by 72.8 MMbbls or 15% YoY. US crude oil inventories were down ~23% from their peak.

Impact

Cushing inventories declined ~39% from their peak. Since then, US crude oil (DWT) prices have risen ~22%. Cushing inventories were near the lowest level since January 2015. Any drop in US and Cushing inventories could benefit oil (UWT) prices.

Next, we’ll discuss US crude oil rigs.