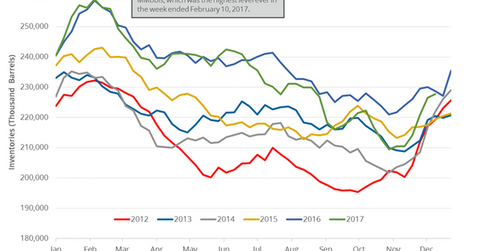

US Gasoline Inventories: Bearish Driver for Crude Oil Futures

The EIA estimated that US gasoline inventories rose by 1.2 MMbbls (million barrels) to 227.7 MMbbls on December 8–15, 2017.

Dec. 21 2017, Updated 10:45 a.m. ET

US gasoline inventories

The EIA estimated that US gasoline inventories rose by 1.2 MMbbls (million barrels) to 227.7 MMbbls on December 8–15, 2017. Inventories rose 0.5% week-over-week, but fell by 0.9 MMbbls or 0.4% YoY (year-over-year).

Analysts expected that US gasoline inventories could have risen by 2.2 MMbbls on December 8–15, 2017.

Gasoline (UGA) and crude oil (UWT) (UCO) futures rose on December 20, 2017. US gasoline futures rose 2.3% to $1.73 per gallon on December 20, 2017. Crude oil (USO) prices were near a 30-month high. Higher oil (USL) prices have a positive impact on oil producers (FXN) (IXC) like W&T Offshore (WTI), Bill Barrett (BBG), and Contango Oil & Gas (MCF).

Similarly, higher gasoline prices have a positive impact on US refiners (CRAK) like Marathon Petroleum (MPC) and CVR Energy (CVI).

US gasoline production and demand

The EIA estimates that US gasoline production fell by 64,000 bpd (barrels per day) or 0.6% to 10.1 MMbpd (million barrels per day) on December 8–15, 2017. The production also fell by 85,000 bpd or 0.8% YoY.

US gasoline demand rose by 335,000 bpd or 3.7% to 9.4 MMbpd on December 8–15, 2017. The demand also rose by 157,000 bpd or 1.7% YoY. An increase in gasoline demand has a positive impact on gasoline and oil (USO) prices.

Impact

US gasoline inventories rose for the sixth straight week. Inventories rose by 18.2 MMbbls or 8.7% during this period. If the momentum continues in 2018, it will pressure gasoline (UGA) and oil prices.

US gasoline inventories are almost 3% above their five-year average for the week ending December 15, 2017. Any increase in gasoline inventories is bearish for gasoline and oil (DWT) prices.

Next, we’ll discuss how US distillate inventories impact oil prices.