US Distillate Inventories Fell for the First Time in 4 Weeks

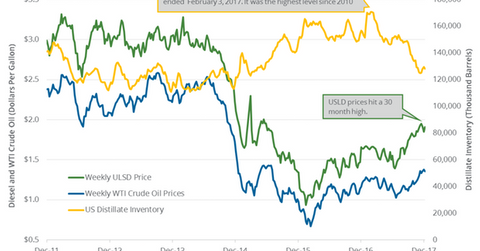

US distillate inventories fell by 1.3 MMbbls (million barrels) to 128.1 MMbbls on December 1–8, 2017, according to the EIA.

Dec. 14 2017, Published 8:14 a.m. ET

US distillate inventories

US distillate inventories fell by 1.3 MMbbls (million barrels) to 128.1 MMbbls on December 1–8, 2017, according to the EIA. Inventories fell 1.1% week-over-week and by 27.8 MMbbls or 17.8% YoY (year-over-year).

The market survey estimated that US distillate inventories would have risen by 0.9 MMbbls on December 1–8, 2017. US diesel and oil (UWT) (DBO) prices fell on December 13, 2017, despite the unexpected draw in distillate inventories. US diesel futures fell 1.5% to $1.9 per gallon on December 13, 2017.

Lower diesel prices have a negative impact on refiners (CRAK) like Marathon Petroleum (MPC) and Valero (VLO). Similarly, lower oil (UWT) prices have a negative impact on oil producers (FENY) (IYE) like Stone Energy (SGY), SM Energy (SM), and Goodrich Petroleum (GDP).

US distillate production and demand

US distillate production fell by 155,000 bpd (barrels per day) to 5.2 MMbpd (million barrels per day) on December 1–8, 2017. However, production rose by 238,000 bpd or 4.7% YoY.

US distillate demand rose by 643,000 bpd to 4.4 MMbpd on December 1–8, 2017. Demand rose 17% week-over-week and by 350,000 bpd or 8.6% YoY. Any rise in demand is bullish for diesel and oil (UWT) prices.

Impact

US distillate inventories rose almost 3% in the last five weeks. It’s bearish for diesel and oil (UCO) prices. However, US distillate inventories fell for the first time in four weeks. They’re also below their five-year average, which is bullish for diesel and oil (USO) prices.

For updates on crude oil and natural gas, read Crude Oil Prices Could End 2017 on a High Note and US Natural Gas Futures Could Maintain Bearish Momentum.