Could Natural Gas Reach a New 2017 Low Next Week?

Implied volatility On December 21, 2017, natural gas futures’ implied volatility was 42.4%. In the last trading session, their implied volatility was on par with the 15-day average. Supply-glut concerns pushed natural gas (UNG) (BOIL) futures to a 17-year low on March 3, 2016, with an implied volatility of 53.8%. From this multiyear low, natural gas prices […]

Nov. 20 2020, Updated 2:58 p.m. ET

Implied volatility

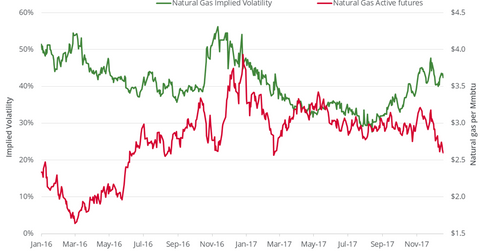

On December 21, 2017, natural gas futures’ implied volatility was 42.4%. In the last trading session, their implied volatility was on par with the 15-day average.

Supply-glut concerns pushed natural gas (UNG) (BOIL) futures to a 17-year low on March 3, 2016, with an implied volatility of 53.8%. From this multiyear low, natural gas prices rose 58.5%, while their implied volatility fell 21.2%.

Natural gas prices next week

Assuming that natural gas prices are normally distributed, and using their latest implied volatility of 42.4%, natural gas active futures could close between $2.44 and $2.74 per MMBtu (million British thermal units) between December 22 and December 28, 2017. For this price range, the probability is 68%, with a standard deviation of one.

On December 21, 2017, natural gas (GASL) (GASX) February futures closed at $2.60 per MMBtu—1.5% above their 2017 lowest closing price. If natural gas reaches a new 2017 low, then the United States Natural Gas ETF (UNG), the ProShares Ultra Bloomberg Natural Gas ETF (BOIL), and the First Trust ISE-Revere Natural Gas ETF (FCG) could also incur further losses. These ETFs invest in natural gas. Visit our Energy and Power page for energy updates.