FOMC Meeting Could Surprise Crude Oil Traders

US crude oil (UCO) (USL) futures contracts for January delivery rose 0.7% and were trading at $58.4 per barrel at 1:02 AM EST on December 12, 2017.

Nov. 20 2020, Updated 12:26 p.m. ET

US crude oil futures

US crude oil (UCO) (USL) futures contracts for January delivery rose 0.7% and were trading at $58.4 per barrel at 1:02 AM EST on December 12, 2017. The possible strike in Nigeria supported oil (SCO) prices. Prices also rose ahead of the API’s (American Petroleum Institute) crude oil inventory report. The report will be released on December 12, 2017.

Likewise, March E-Mini S&P 500 (SPY) (SPX-INDEX) futures contracts rose 0.05% to 2,665.75 at 1:02 AM EST on December 12, 2017.

FOMC meeting

The FOMC’s (Federal Open Market Committee) two-day meeting will be held on December 12–13, 2017. The Fed is expected to raise the US interest rate during this meeting.

There’s an 85% probability of the Fed increasing the US interest rate 0.25% at the meeting, according to the CME Fedwatch tool. There’s 15% chance of the Fed increasing the US interest rate 0.5%. Any increase in the US interest rate would strengthen the US dollar.

US dollar and crude oil

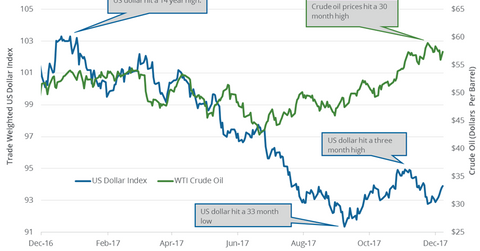

Crude oil is a dollar-denominated commodity. Crude oil (USO) and the dollar (UUP) are usually inversely related. The US dollar is at a two-week high ahead of the Fed’s meeting.

The strengthening dollar will cap the upside for oil (UWT) prices. Moves in oil prices impact funds like the Guggenheim S&P 500 Equal Weight Energy ETF (RYE) and the Vanguard Energy ETF (VDE). These ETFs rose 1.1% and 0.9% on December 11, 2017.

A Reuters poll estimated that the Fed would increase the US interest rate three times in 2018. It’s bullish for the dollar, which is bearish for oil. Any surprise announcement in the Fed’s two-day meeting could pressure the dollar, which is bullish for oil. Sluggish inflation is the Fed’s main concern.

Next, we’ll discuss US crude oil inventories and the output.