What Factors Could Drive Coeur Mining Stock in 2018?

Coeur Mining (CDE) was one of the stocks to gain significantly in 2016, rising ~270%. The situation in 2017 has reversed completely.

Dec. 1 2017, Updated 11:47 a.m. ET

Coeur Mining’s performance in 2017

Coeur Mining (CDE) was one of the stocks to gain significantly in 2016, rising ~270%. The situation in 2017 has reversed completely. CDE has fallen 15% year-to-date (or YTD) as of November 24, 2017. While higher precious metal prices (GLD) (SLV) and Coeur’s higher operational leverage led to its rise in 2016, the company-specific issues have negatively impacted the stock in 2017. Its operational performance in 2017 thus far has been weaker than expected.

Underperformance YTD

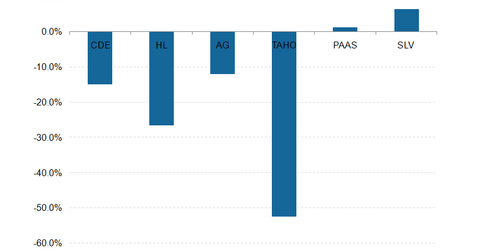

The weaker stock performance in 2017 is not just limited to Coeur. Most of the silver miners have been languishing in 2017. In fact, among the primary silver miners (SIL), Coeur’s stock performance has been better so far this year than the performances of Hecla Mining (HL) and Tahoe Resources (TAHO). These two miners have fallen 26.5% and 52.4%, respectively, YTD. Issues at Hecla’s Lucky Friday mine in Idaho have plagued the stock in 2017, and Tahoe has been under significant pressure after the Guatemalan government canceled the license for its flagship Escobal mine. The license was subsequently reinstated, but the illegal roadblock to the mine continues, impacting the operations and the mine.

First Majestic Silver (AG) has fallen 11.9% YTD, while Pan American Silver (PAAS) is the only primary silver miner to have gained YTD, rising 1.2% so far in 2017. Silver prices (SLV) have risen 6.4% YTD.

Series overview

After CDE’s weak performance YTD, the question now is this: Will this performance continue, or are there better prospects for the stock going forward? In this series, we’ll analyze the company’s performance variables such as production growth, cost progression, and balance sheet position. We’ll also explore its near-term challenges and opportunities to see how the stock might progress going forward.

Let’s start by looking at the company’s production levels.