Analyzing US Gasoline Inventories and Demand

The API reported that US gasoline and distillate inventories rose by 9,200,000 barrels and 4,300,000 barrels on November 24–December 1, 2017.

Dec. 6 2017, Published 8:43 a.m. ET

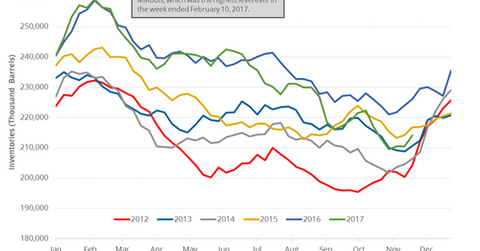

Gasoline and distillate inventories

On December 5, 2017, the API (American Petroleum Institute) published its crude oil inventory report. It reported that US gasoline and distillate inventories rose by 9,200,000 barrels and 4,300,000 barrels on November 24–December 1, 2017.

Market surveys estimated that US gasoline and distillate inventories could have risen by 1,741,000 barrels and 967,000 barrels during the same period. The EIA will release the crude oil inventory report today (December 6, 2017). If the EIA reports a larger-than-expected increase in gasoline and distillate inventories, it would pressure gasoline, diesel, and oil (UWT) (DWT) prices.

US gasoline demand

US gasoline demand fell by 871,000 bpd (barrels per day) or 9% to 8,724,000 bpd on November 17–24, according to the EIA. The demand also fell by 356,000 bpd or 3.9% from the same period in 2016.

Any fall in gasoline demand is bearish for gasoline (UGA) and oil (SCO) (USL) prices. Lower gasoline prices have a negative impact on US refining companies like Western Refining (WNR) and Marathon Petroleum (MPC).

Similarly, lower oil prices have a negative impact on energy companies’ (FENY) (FXN) earnings like Cobalt International Energy (CIE), EOG Resources (EOG), and Energen (EGN).

Impact

The EIA will release US gasoline inventories and demand data on December 6, 2017. Any fall in US gasoline demand could pressure gasoline and oil (USO) (UCO) prices. However, the EIA estimates that US gasoline demand would hit a record in 2018. Any increase in US gasoline demand could support gasoline and oil prices.

Next, we’ll cover the latest crude oil price forecasts.