Why MLPs Saw a New 52-Week Low Last Week

MLPs went through some carnage last week. The Alerian MLP Index (^AMZ), which tracks the performance of 50 energy MLPs, saw a new 52-week low of 258.45.

Nov. 20 2020, Updated 12:15 p.m. ET

AMZ fell 2.8% last week

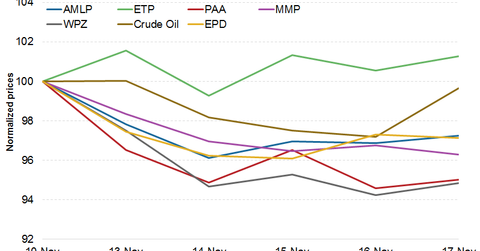

MLPs went through some carnage last week. The Alerian MLP Index (^AMZ), which tracks the performance of 50 energy MLPs, saw a new 52-week low of 258.45. Overall, the index fell 2.8% to end at $260.1. Many MLPs saw new 52-week lows last week, and 27 out of 93 are currently trading at a difference of less than 5% to their 52-week lows.

Out of the total 93 MLPs, 81 ended in the red, nine ended in the green, and the remaining three ended the week flat. Among the top MLPs by market capitalization, Williams Partners (WPZ), Plains All American Pipelines (PAA), and Enterprise Products Partners (EPD) fell 5.2%, 5.0%, and 2.9%, respectively, while Energy Transfer Partners (ETP) rose 1.3%. We’ll look into the performance drivers for the top MLP losers and gainers later in this series.

The Alerian MLP ETF (AMLP) comprises 25 energy MLPs. It fell 2.7% during the week. AMLP outperformed the Energy Select Sector SPDR Fund (XLE) last week, and it underperformed the SPDR S&P 500 ETF (SPY)(SPX-INDEX). XLE fell 3.2% while SPY ended the week flat.

MLPs weakness last weak could be attributed to general pessimism in the energy sector due to a recent correction in crude oil and natural gas prices. US crude oil fell 0.3% last week to end the week at $56.55 per barrel while natural gas fell 3.6%, ending the week at $3.1 per MMBtu (million British thermal units). For recent updates and an outlook on crude oil prices, see How Much US Crude Oil Could Fall Next Week.

Fund flows

The Alerian MLP ETF saw an outflow of $60.3 million funds last week due to the recent weakness. On the other hand, the JPMorgan Alerian MLP Index ETN (AMJ) continued to experience net inflows. It saw a net inflow of $98.6 million funds last week.