US Gasoline Demand Could Drive Crude Oil Prices Higher

The EIA estimates that weekly US gasoline demand rose by 147,000 bpd (barrels per day) to 9,461,000 bpd on October 20–27, 2017.

Nov. 8 2017, Published 9:37 a.m. ET

Weekly US gasoline demand

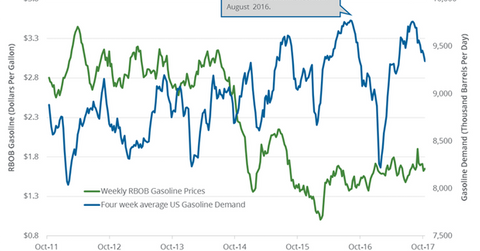

The EIA (U.S. Energy Information Administration) estimates that weekly US gasoline demand rose by 147,000 bpd (barrels per day) to 9,461,000 bpd on October 20–27, 2017. US gasoline demand rose 1.6% week-over-week and by 278,000 bpd or 3% YoY (year-over-year). The four-week average US gasoline demand rose by 55,000 bpd to 9,348,000 bpd on October 20–27, 2017. Gasoline demand rose 0.6% week-over-week and by 257,000 bpd or 2.8% YoY. A rise in gasoline demand will likely have a positive impact on gasoline (UGA) and crude oil (DTO) (OIL) (UWT) (DWT) prices. Higher oil prices benefit oil producers (IYE) (IXC) like Anadarko Petroleum (APC) and Cobalt International Energy (CIE).

Peak and low

US gasoline demand tested an all-time high of 9,800,000 bpd in July 2017. On the other hand, gasoline demand tested 8,000,000 bpd in January 2017—the lowest level since February 2014. Gasoline demand has risen 18.2% or by 1,461,000 bpd since the January 2017 lows. Lower gasoline prices and US drivers traveling longer distances supported US gasoline demand. A rise in gasoline demand benefits gasoline prices and US refiners (CRAK) like Western Refining (WNR), CVR Energy (CVI), and Valero (VLO).

US gasoline consumption estimates

The EIA published its STEO (Short-Term Energy Outlook) report on November 7, 2017. It estimates that US gasoline consumption would average 9.33 MMbpd in 2017. It’s 0.1% higher than the estimates from the October STEO report. The EIA also estimates that US gasoline consumption will average 9.35 MMbpd in 2018—0.2% lower than the previous estimates. Consumption averaged a record 9.32 MMbpd in 2016 and 9.18 MMbpd in 2015.