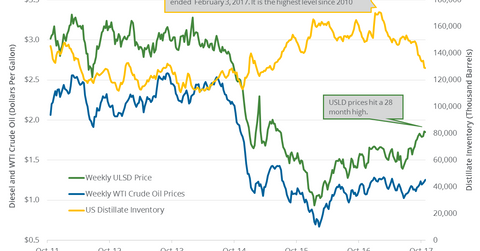

US Distillate Inventories Are near a 3-Year Low

US distillate inventories fell by 302,000 barrels to 128.9 MMbbls (million barrels) on October 20–27, 2017. It’s the lowest level since April 10, 2015.

Nov. 20 2020, Updated 11:49 a.m. ET

US distillate inventories

According to the EIA (U.S. Energy Information Administration), US distillate inventories fell by 302,000 barrels to 128.9 MMbbls (million barrels) on October 20–27, 2017. It’s the lowest level since April 10, 2015. The inventories have fallen by 21.6 MMbbls or 14.4% YoY (year-over-year).

The market expected that US distillate inventories would have fallen by 2,128,000 barrels on October 20–27, 2017. US diesel futures fell on November 2, 2017, due to the less-than-expected fall in distillate inventories. They fell 0.5% to $1.85 per gallon on the same day. However, US crude oil (USL) (UCO) prices rose on November 2, 2017.

Volatility in diesel and oil (UWT) (DWT) prices influences oil producers (IEO) (IEZ) and refiners’ (CRAK) earnings. US crude oil prices are at a 28-month high. High oil prices benefit oil producers like EOG Resources (EOG), Chevron (CVX), and Northern Oil & Gas (NOG).

US distillate production and demand

US distillate production rose by 241,000 bpd (barrels per day) to 5,036,000 bpd on October 20–27, 2017. The distillate production rose 5% week-over-week and by 374,000 bpd or 8% YoY.

US distillate demand fell by 567,000 bpd to 3,534,000 bpd on October 20–27, 2017. The demand fell 13.8% week-over-week and by 329,000 bpd or 8.5% YoY.

Impact

US distillate inventories have fallen 32.5% or by 42 MMbbls from its peak. Any fall in distillate inventories is bullish for diesel and crude oil (USO) (USL) prices.

Read WTI and Brent Crude Oil Futures Could Test New Highs for the latest updates on crude oil. Read These Key Factors Are Driving the US Natural Gas Market for updates on natural gas.