US Crude Oil at New 2017 High: Is Risk Rising?

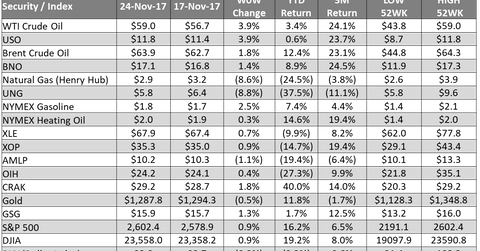

Between November 17 and November 24, 2017, US crude oil (USO) (USL) January futures rose 3.9%.

Nov. 20 2020, Updated 11:17 a.m. ET

US crude oil

Between November 17 and November 24, 2017, US crude oil (USO) (USL) January futures rose 3.9%. On November 24, US crude oil active futures closed at $58.95 per barrel, the highest closing price in 2017 to date.

What’s causing the upside in oil prices?

News reports suggested that Russia and OPEC will very likely extend the production cut deal through 2018, which could have pushed oil prices to the new high. The OPEC and other major oil producing countries will meet on November 30, 2017, to decide on the production cut deal. Moreover, the US dollar (UUP) fell 0.9% last week, which could have boosted oil prices.

In the week ended November 24, 2017, US crude oil outperformed Brent crude oil. The halt in the Keystone Pipeline’s operations could be behind WTI crude oil’s outperformance.

However, on November 22, 2017, the oil rig count rose by nine from a week before to 747. The risk surrounding US crude oil production could trouble oil bulls, which could also weigh on natural gas prices.

Natural gas

Between November 17 and November 24, natural gas active futures fell 8.6%. On the latter date, natural gas active futures closed at $2.91 per MMBtu. Supply concerns could be behind natural gas’s fall. Moreover, the moderate weather forecast report could add more downside to natural gas prices this week.

Between November 17 and November 24, 2017, the S&P 500 Index (SPY) and the Dow Jones Industrial Average Index (DIA) both rose 0.9%. To know more about price performance of other equity indexes, continue to the next part.