US Crude Oil Inventory Report Might Disappoint Traders

An unexpected increase in US oil inventories pressured WTI oil (USO) (UCO) prices in post-settlement trade on November 28, 2017.

Nov. 20 2020, Updated 4:55 p.m. ET

WTI Crude oil futures

WTI (West Texas Intermediate) crude oil (USL) (SCO) futures contracts for January delivery fell 0.5% to $57.69 per barrel in electronic exchange at 12:55 AM EST on November 29, 2017. Prices fell due to the API’s (American Petroleum Institute) bearish crude oil inventory report. The report was released yesterday. Lower oil prices have a negative impact on oil producers’ (RYE) (XLE) profitability like Denbury Resources (DNR), Chevron (CVX), Carrizo Oil & Gas (CRZO), and EOG Resources (EOG).

Meanwhile, December E-Mini S&P 500 (SPY) futures contracts fell 0.05% to 2,624.75 during the same period.

API’s crude oil inventory estimates

US crude oil inventories rose by 1,821,000 barrels on November 17–24, 2017, according to the API. A Bloomberg survey estimated that inventories would have fallen by 2,950,000 barrels during the same week.

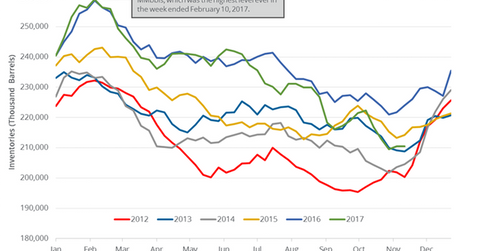

An unexpected increase in US oil inventories pressured WTI oil (USO) (UCO) prices in post-settlement trade on November 28, 2017. US crude oil inventories are 14.3% above their five-year average, which was also bearish for oil (DBO) (UWT) prices.

API’s gasoline and distillate inventories

US gasoline inventories fell by 1,529,000 barrels on November 17–24, 2017, according to the API. However, distillate inventories rose by 2,696,000 barrels during the same week. Market surveys expect that US gasoline inventories could have risen by 1,170,000 barrels during the same period. The surveys also estimated that US distillate inventories could have risen by 230,000 barrels.

EIA’s US crude oil inventories

The EIA will release its weekly crude oil inventory report on November 29, 2017. If the EIA reports a surprise increase in US crude oil inventories, it could pressure oil (UWT) prices. Any rise in gasoline or distillate inventories could also pressure oil prices.

Next, we’ll cover US gasoline demand.