US Crude Oil Exports Could Be at a Tipping Point

On October 31, 2017, Brent crude oil (BNO) active futures were ~$7 above US crude oil (UCO) futures.

Nov. 20 2020, Updated 11:54 a.m. ET

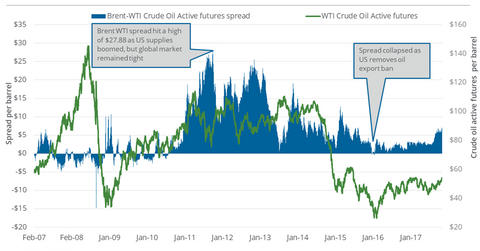

Brent-WTI spread

On October 31, 2017, Brent crude oil (BNO) active futures were ~$7 above US crude oil (UCO) futures. On October 24, 2017, the difference between these two grades of oil, or the Brent-WTI spread, was at $5.9. Between these two dates, US crude oil December futures rose 3.6%, and Brent crude oil January futures rose 4.8%.

US crude oil exports

In the week ended October 20, 2017, US crude oil exports were at 1.9 million barrels per day, which could pose a threat to oil prices. Before the OPEC supply cut deal, oil prices fell as Saudi Arabia raised its oil supply to counter rising US shale oil production. So, rising US exports may undo OPEC’s efforts to raise international oil prices.

On a year-over-year basis, US crude oil exports have risen by ~1.5 million barrels a day. During this period, the Brent-WTI spread has widened by over $5. The rise in the Brent-WTI spread is an advantage for US crude oil exporters because it helps cover their transportation costs and increases their profits, as they can sell internationally at higher prices.

But at the same time, in domestic markets, US crude oil producers (XOP) (DRIP) (IEO) could earn lower revenues compared to their international peers. However, the situation is advantageous for US refineries (CRAK) because their refined products follow higher Brent prices, while their input costs are related to cheaper WTI prices.

For more analysis on the energy sector, follow our Energy and Power page.