Understanding the Natural Gas Futures Spread: Are Oversupply Concerns Rising?

On November 1, natural gas December 2018 futures settled $0.22 above December 2017 futures. On October 25, the futures spread was at a premium of $0.11.

Nov. 2 2017, Published 3:52 p.m. ET

Futures spread

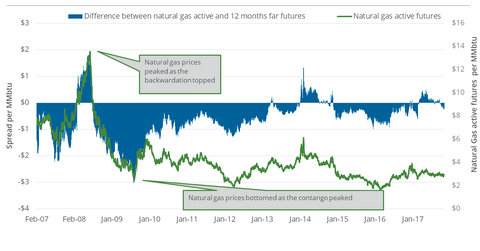

On November 1, 2017, natural gas (UNG) (FCG) December 2018 futures settled $0.22 above December 2017 futures. (The difference between the futures contract is referred to as the “futures spread.”)

On October 25, 2017, the futures spread was at a premium of $0.11, which means that December 2018 futures settled $0.11 above December 2017 futures. Between October 25 and November 1, 2017, natural gas December futures fell 6.1%.

Premium

The futures spread at a premium could hint at concerns surrounding natural gas demand-supply and can pressure prices lower. For example, the futures spread was at a premium of $0.84 on March 3, 2016. On the same day, natural gas prices closed at their 17-year lowest closing price.

Any rise in the premium could restrict the upside in natural gas.

Discount

The futures spread at a discount could encourage natural gas bulls. For example, the futures spread was at a discount of $0.5 on May 12, 2017. On the same day, natural gas prices closed at their 2017 highest closing price.

Any rise in the discount could restrict the fall in natural gas.

What happened in the past few days?

In the seven calendar days leading up to November 1, 2017, the futures spread premium expanded. Natural gas futures fell 6.1% during that same period, and so oversupply concerns likely loom over natural gas prices.

Energy sector

US natural gas producers’ (XOP) (DRIP) (IEO) operations to manage risks in their output prices take into consideration the natural gas futures forward curve. This forward curve is also crucial for midstream natural gas transportation, storage, and processing companies (AMLP).

On November 1, 2017, natural gas January 2018 futures settled $0.12 above the December 2017 futures. Given this kind of a price difference, ETFs such as the ProShares Ultra Bloomberg Natural Gas (BOIL) and the United States Natural Gas Fund LP (UNG) may fare worse than natural gas futures as their rollover costs to active futures increases. Notably, these ETFs are supposed to follow natural gas futures.

On November 1, 2017, the prices of natural gas futures contracts for delivery until February 2018 traded in an ascending order.