How Much Natural Gas Could Fall Next Week

On November 16, 2017, the implied volatility of natural gas was 44%—6.4% above its 15-day average.

Nov. 20 2020, Updated 5:30 p.m. ET

Natural gas volatility

On November 16, 2017, the implied volatility of natural gas was 44%—6.4% above its 15-day average.

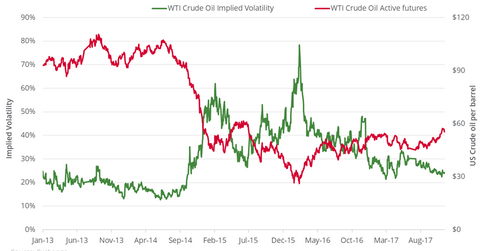

Usually, natural gas (GASL) (GASX) prices and the implied volatility of natural gas move in divergence. The graph above illustrates this relationship.

For example, on March 3, 2016, the implied volatility of natural gas spiked to 53.8%, while natural gas prices hit a 17-year low. Between March 3, 2016, and November 16, 2017, natural gas prices rose 86.3%, while the implied volatility of natural gas fell 18.2%.

Price forecast

In the next seven days, natural gas active futures could settle between $2.87 and $3.24 per MMBtu (million British thermal units). The probability of prices settling in this range is 68%. For this model, prices are assumed to be normally distributed, and an implied volatility of 44% is being used.

On November 16, 2017, natural gas active futures settled at $3.053 per MMBtu. Any further fall from this closing price could thus make natural gas prices fall below the $3 mark. Notably, the recent momentum has been negative, despite bullish inventory data.

Such a fall could negatively impact ETFs such as the United States Natural Gas Fund LP (UNG), the ProShares Ultra Bloomberg Natural Gas (BOIL), and the First Trust ISE-Revere Natural Gas ETF (FCG). These ETFs have direct exposure to natural gas futures.

For more update on natural gas prices, keep checking in with Market Realist’s Energy and Power page.