How Merck’s Diabetes Portfolio Performed in 2Q17

Merck’s (MRK) diabetes portfolio includes drugs used for controlling the blood sugar levels for patients with diabetes.

Sept. 12 2017, Updated 7:37 a.m. ET

Merck’s diabetes portfolio

Merck’s (MRK) diabetes portfolio includes drugs used for controlling the blood sugar levels for patients with diabetes. The portfolio includes two blockbuster drugs, Januvia and Janumet, which are used to lower blood sugar levels in patients with type-2 diabetes.

Januvia and Janumet: performance

Januvia and Janumet are DPP-4 inhibitors that help to maintain lower blood sugar levels in patients with type-2 diabetes. DPP-4 stands for Dipeptidyl Peptidase-4 enzyme, which removes incretin from the human body in normal cases (for people without type-2 diabetes).

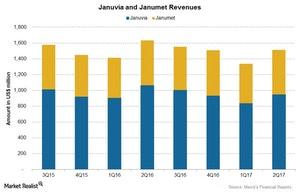

For 2Q17, the drugs Januvia and Janumet reported combined revenues of ~$1.51 billion, representing a 7% fall in revenues at constant exchange rates, compared with $1.63 billion in 2Q16, driven by lower sales of the drug in 2Q17.

Januvia reported lower sales in both the US as well as in international markets during 2Q17. Janumet reported lower sales in US markets, partially offset by growth in international markets.

Other drugs for lowering blood sugar levels in patients with type-2 diabetes include Onglyza, a drug co-developed by Bristol-Myers Squibb (BMY) and AstraZeneca (AZN), Trajenta from Boehringer Ingelheim, and Kombiglyze from AstraZeneca (AZN).

To divest company-specific risks, investors can consider ETFs like the PowerShares Dynamic Pharmaceuticals ETF (PJP), which has 4.9% of its total assets in Merck (MRK). PJP also has 5.4% in Gilead Sciences (GILD), 5.0% in Bristol-Myers Squibb (BMY), and 2.7% in Eli Lilly (LLY).