These Gold Miners Surprised Us with Unit Costs in 3Q17

AISC (all-in sustaining costs) are an encompassing measure that helps compare miners’ performance—a vital metric for investors. They show the company’s margin cushion at prevailing gold prices (GLD)(IAU).

Dec. 4 2020, Updated 10:53 a.m. ET

All-in sustaining costs and gold miners

AISC (all-in sustaining costs) are an encompassing measure that helps compare miners’ performance—a vital metric for investors. They show the company’s margin cushion at prevailing gold prices (GLD)(IAU). See Gold companies’ cash costs and all-in sustaining cash costs for a detailed overview of AISC and its components.

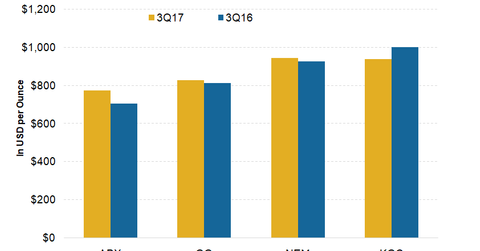

While Barrick Gold (ABX) maintained its cost supremacy in 3Q17 with the lowest costs among the four senior miners, its AISC costs rose 10% year-over-year (or YoY). It reported AISC of $772 per ounce in 3Q17. Higher costs were mainly due to a planned increase in mine site sustaining capital expenditures at its Veladero and Nevada mines. Lower volumes sold were also responsible for higher costs.

In line with narrowing production guidance, the company narrowed its AISC guidance from $720–$770 per ounce to $740–$770 per ounce.

GG and NEM: AISC

Goldcorp’s (GG) AISC also rose, by 1.8% YoY to $827 per ounce in 3Q17. Lower gold sales and higher unit costs led to higher unit costs for the company. In 2Q17, GG reduced its AISC guidance from $850 per ounce to $825 per ounce +/-5%. In 3Q17 results, the company maintained its AISC guidance. By 2021, it expects to achieve AISC of $700 per ounce.

Newmont Mining (NEM) also reported higher AISC in 3Q17. Its AISC of $943 per ounce were 1.9% higher YoY and 6.7% sequentially. Lower grades at its maturing operations and more investment in exploration led to the higher costs. After improving its AISC guidance from $950–$1,000 per ounce to $900–$950 per ounce in 2Q17, the company maintained its guidance in its 3Q17 results. The company expects its newest nine mines to add volumes at just $750 per ounce of AISC for the first five years, which should lower its overall unit costs going forward.

Still on the higher side

Kinross Gold’s (KGC) AISC of $937 per ounce in 3Q17 were 6.4% lower YoY. Lower costs were mainly due to the decrease in production costs and lower sustaining capital expenditures. While the company maintained its AISC guidance for 2017 of $925–$1,025 per ounce, it mentioned that it’s tracking toward the lower end of this guidance. Its newer projects could help the company reduce its costs even further going forward.

In the next part of this series, we’ll look at these companies’ financial leverages.