Why Speculators Continue to Bet against the US Dollar

The US Dollar Index (UUP) continued its rally last week, closing at 92.88 and posting a gain of 0.99% for the week.

Oct. 3 2017, Updated 7:43 a.m. ET

US dollar posted another weekly gain

The US Dollar Index (UUP) continued its rally last week, closing at 92.88 and posting a gain of 0.99% for the week. A tax reform announcement from Trump was the key reason for the bounce in the US dollar. The other factor that drove the US dollar last week might not have had a positive impact on the US dollar. Fed members, who spoke last week, sounded doubtful about a December rate hike.

September is only the second positive month for the index this year, and it looks challenging for the index to keep this positive momentum going into the fourth quarter. Let’s see why the US dollar could stall.

Speculators continue to increase negative bets on the US dollar

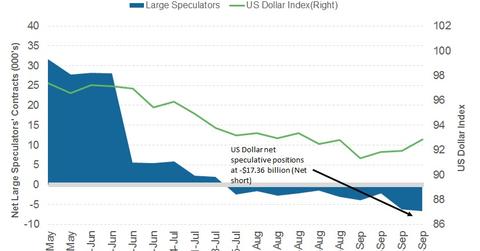

As per the latest “Commitment of Traders” (or COT) report released on September 29 by the Chicago Futures Trading Commission (or CFTC), large speculators and traders continued to add to bearish positions on the US dollar last week. It’s surprising that large speculators are adding short positions despite the US dollar surging in the last two weeks. They could be positioning for further declines ahead. If economic data remain weak in the coming months, the US Fed could be forced to refrain from tightening, leaving the US dollar valued lower than its peers.

As per Reuters calculations, net US dollar (USDU) net short positions rose to -$17.36 billion, compared to -$13.19 billion in the previous week. This amount is a combination of the US dollar’s contracts against the combined contracts of the euro (FXE), British pound (FXB), Japanese yen (FXY), Australian dollar (FXA), Canadian dollar (FXC), and Swiss franc.

Outlook for the US dollar

Employment data on Friday is the key economic data for the week, but markets are likely to ignore the negative data, factoring in the impact of hurricanes Harvey and Irma. The focus is likely to remain on the divergent monetary policy between the United States, the Europen Union, and the United Kingdom. In the absence of any surprise positive data from the United States, the US dollar rally could stall this week.

In the next part of this series, we’ll analyze why US bond markets fell last week.