US Crude Oil Inventories and Production Impact Crude Oil Prices

The market expects that US crude oil inventories could have fallen by 2.5 MMbbls (million barrels) on October 20–27, 2017.

Oct. 31 2017, Updated 1:15 p.m. ET

API and EIA’s crude oil inventories

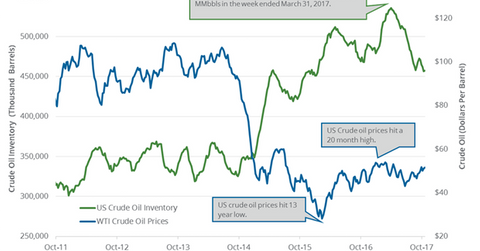

The API (American Petroleum Institute) will release its crude oil inventory report on October 31, 2017. The market expects that US crude oil inventories could have fallen by 2.5 MMbbls (million barrels) on October 20–27, 2017. A bigger-than-expected draw in US crude oil inventories could help oil (OIL) (DBO) prices. The expectation of a fall in gasoline and distillate inventories could also support gasoline, diesel, and crude oil prices.

US crude oil (USO) (SCO) prices are at an eight-month high. However, US crude oil inventories were 16.7% higher than the five-year average for the week ending October 20, 2017. The EIA (U.S. Energy Information Administration) will release its weekly crude oil inventories report on November 1, 2017. Any rise in US oil inventories could cap the upside for oil (UWT) (DWT) prices.

US crude oil production

US crude oil production rose by 1,101,000 bpd (barrels per day) to 9,507,000 bpd on October 13–20, 2017. The production rose by 1,003,000 bpd or 11.8% year-over-year. High US production pressured crude oil prices in 2017. US oil (USO) (SCO) prices have fallen 5.4% year-to-date.

However, US crude oil prices have risen ~25% or by $10.64 per barrel since the lows in June 2017. Brent crude oil prices have risen ~32.6% or by $14.96 per barrel since the lows in June 2017. Higher oil prices will support US crude oil production. US crude oil production is expected to hit annual record in 2018. Changes oil prices impact oil producers’ (FXN) (IEO) earnings like Warren Resources (WRES) and QEP Resources (QEP).