How UNG Fared Compared to Natural Gas Last Week

On September 22–29, 2017, the United States Natural Gas Fund LP (UNG) rose 0.2%, while natural gas (BOIL) November futures fell 0.5%.

Oct. 2 2017, Updated 3:06 p.m. ET

Natural gas and UNG

On September 22–29, 2017, the United States Natural Gas Fund LP (UNG) rose 0.2%, while natural gas (BOIL) November futures fell 0.5%. UNG is meant to track natural gas near-month futures contracts. Last week, UNG outperformed natural gas November futures.

Performances since March 3, 2016

On March 3, 2016, natural gas active futures fell to their 17-year low. Since then, natural gas prices recovered 83.5%. However, UNG rose 13.5% during this period. UNG could have underperformed because of the “negative roll yield.”

UNG shifts holdings in active natural gas (FCG) (GASL) (GASX) futures to the following month futures contract if the active futures contract expiry is within two weeks. The fund could incur losses if the next month’s futures trade at higher levels compared to the expiring futures when it shifts its holdings. In this case, the roll yield would be negative.

On September 29, 2017, natural gas futures contracts out to February 2018 settled at progressively higher prices.

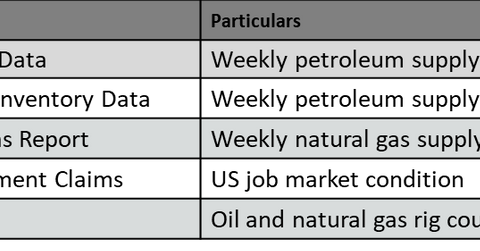

In the next part, we’ll discuss the key energy events this week.