How Moat Indexes Performed in September

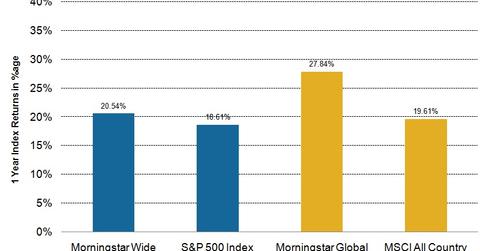

The US Moat Index has been performing fairly well this year. As of September 30, 2017, it has outperformed, rising 20.5% over the S&P 500 Index’s (SPY) (SPX-INDEX) rise of 18.6% YTD.

Nov. 20 2020, Updated 2:17 p.m. ET

VanEck

Performance Overview

Global moat stocks underperformed their respective broad markets in September. International moats, as represented by the Morningstar Global ex-US Moat Focus Index (MGEUMFUN, or “International Moat Index”), posted a 1.46% return compared to 1.86% for the MSCI All Country World Index ex-USA (MSCI ACWI ex-USA). September joined April as the only months the International Moat Index underperformed the broad market in 2017. Together, these two occurrences accounted for a total lag of 0.57%. The International Moat Index’s year-to-date outperformance remains well ahead for 2017 (27.36% versus 21.13% for the MSCI ACWI ex-USA).

The U.S.-oriented Morningstar® Wide Moat Focus Index (MWMFTR, or “U.S. Moat Index”) trailed the S&P 500 Index slightly in September (1.94% vs. 2.06%).

Market Realist

How moat indexes benefit

Moat indexes (MOAT) (MOTI) are comprised of companies with an economic moat rating assigned by Morningstar. Economic moats, a term coined and popularized by Warren Buffet, is a competitive advantage a company holds over its competitors in the industry. Morningstar helps investors identify companies with an economic moat or competitive edge. A company with a moat is assigned one of two ratings—wide or narrow—by Morningstar. The chart below shows these five ways to obtain economic moats: network effect, intangible assets, cost advantage, switching costs, and efficient scale.

Obtaining an economic moat rating depends on a company’s ability to earn above-average returns on capital and sustain the returns over a longer period of time.

Morningstar has taken the concept of economic moats a step further by creating the moat indexes, which give investors exposure to companies with a competitive advantage.

US moat indexes: Performance in September

The Morningstar Wide Moat Focus Index, or the US Moat Index (MOAT), provides investors exposure to US stocks that hold a wide moat rating and trade at a discount to Morningstar analysts’ fair value estimates. The US Moat Index has been performing fairly well this year. As of September 30, 2017, the index has outperformed, rising 20.5% over the S&P 500 Index’s (SPY) (SPX-INDEX) rise of 18.6% YTD (year-to-date).

However, for September, the US Moat Index lagged slightly behind, rising 1.9% compared to a 2.1% rise for the S&P 500.

Since the presidential elections in November 2016, the US stock market (SPY) has been soaring. There have also been growing job numbers, an improving economy, and interest rate hikes, which have spiked growth in the S&P 500 Index.

International moat indexes: Performance in September

The Morningstar Global ex-US Moat Focus Index (MOTI), or the International Moat Index, provides exposure to non-US quality stocks in developed and emerging markets. These stocks either hold a wide or narrow moat rating and trade at an attractive price. For September, the International Moat Index lagged behind the iShares MSCI All Country World Index (ACWI), rising 1.4% over the latter’s rise of 1.6%. However, the Morningstar International Moat Index rose 27.8%, outperforming the MSCI All Country World Index’s rise of 19.6% on a YTD basis as of September 30, 2017.

In the rest of this series, we’ll see which companies were the leaders and which ones were the laggards in the Morningstar Moat Indexes for September 2017.