How Global Indicators Are Affecting Precious Metals

Gold reached its two-week high price of $1,294.5 an ounce on Tuesday, October 10, and ended the day at $1292.1 per ounce.

Oct. 12 2017, Updated 2:36 p.m. ET

Precious metals rise

Gold reached its two-week high price of $1,294.5 an ounce on Tuesday, October 10, and ended the day at $1,292.1 per ounce. Silver also rose a whopping 1.4% to close at $17.2 per ounce. Platinum was the top performer on Tuesday, as it rose 2% and closed at $934.7 per ounce. Palladium also saw an up-day with a rise 0.61% to close at $935.1 an ounce. Platinum and palladium have reached parity over the past couple of weeks.

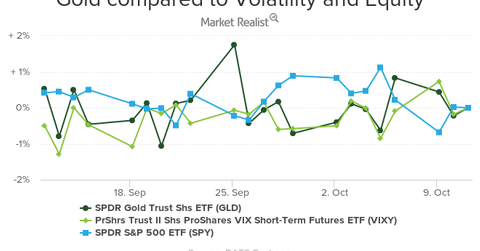

The rise in precious metals was due to the increase in haven bids as the tensions in North Korea have resurfaced. India and Russia have both called for restraint on North Korea. The global tensions also resulted in a sharp fall in equities last month. Gold is known to be negatively related to the equity markets and positively related to volatility.

[marketrealist-chart id=2382342]

Directional move

In the above chart, gold is used for comparison by way of the SPDR Gold Shares (GLD). The volatility index is tracked by the ProShares VIX Short-Term Futures ETF (VIXY), while the equity markets are tracked by the SPDR S&P 500 ETF (SPY).

As the unrest in the market surges due to geopolitical reasons, the VIX rises, and so does the demand for safety assets like gold. During such a turbulent environment, not many investors choose stock markets for investments. The precious metal mining stocks are often known to track the metals that they mine and not directly react to the equity markets.

The mining stocks that have increased over the past five trading days include New Gold (NGD), Silver Wheaton (SLW), Alacer Gold (ASR), and Harmony Gold (HMY). These have a five-day rise of 4.6%, 3.2%, 4.2%, and 3.3%, respectively.