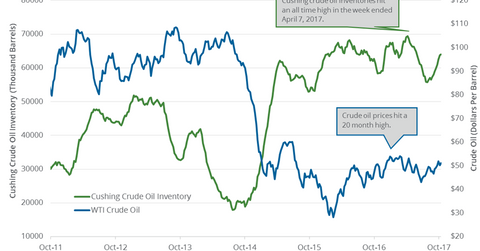

Cushing Inventories Are Near 5-Month High: Bearish for Oil

Wall Street analysts expected that crude oil inventories at Cushing would rise between October 13, 2017, and October 20, 2017.

Oct. 23 2017, Published 10:46 a.m. ET

Cushing inventories

Wall Street analysts expected that crude oil inventories at Cushing would rise between October 13, 2017, and October 20, 2017. Inventories at Cushing rose for the eighth consecutive week in the week ending October 13, 2017. Inventories are near a five-month high.

Any rise in inventories at Cushing could pressure oil (USO) (UWT) (OIL) prices. Cushing, Oklahoma, is the largest crude oil storage facility in the US. Changes in oil prices impact energy producers (FENY) (IEZ) like EOG Resources (EOG), Apache (APA), and Bonanza Creek Energy (BCEI).

EIA’s Cushing inventories

Inventories at Cushing rose by 202,000 barrels to 63.9 MMbbls (million barrels) between October 6 and October 13, 2017. Inventories rose 0.3% week-over-week by 4,287,000 barrels, or 7.2% year-over-year.

EIA’s US crude oil inventories

The EIA estimates that crude oil inventories in the US fell by 5.7 million barrels to 456.4 MMbbls (million barrels) between October 6 and October 13, 2017, the lowest levels since August 25, 2017. US inventories are down ~12,200,000 barrels, or 2.6% year-over-year.

Impact of US and Cushing inventories

For the week ending October 13, 2017, US crude oil inventories are 18% above their five-year average. Inventories at Cushing are up 6,939,000 barrels or 12.1% in the last ten weeks.

High Cushing and US inventories could weigh on crude oil (UCO) (USL) prices. Changes in oil prices impact energy producers (IEZ) (IXC) like Apache and Bonanza Creek Energy.

Next, we’ll analyze how the US oil rig count impacts oil prices.