How Do Analysts View Tahoe Resources despite Its Underperformance?

Tahoe Resources (TAHO) stock has lost 44.1% of its value year-to-date until the end of September.

Oct. 6 2017, Updated 9:13 a.m. ET

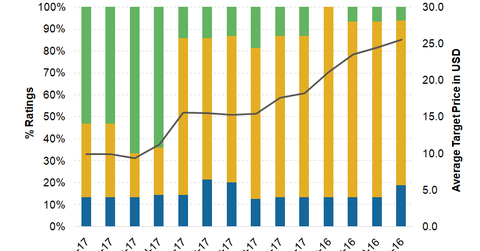

Analyst ratings for TAHO

Tahoe Resources (TAHO) operates five mines in Guatemala, Peru, and Canada. According to the consensus compiled by Thomson Reuters, Tahoe Resources stock is covered by 15 analysts.

TAHO has “buy” ratings from 47.0% of the analysts and “hold” ratings from 53.0% of the analysts, implying no “sell” ratings. Its target price is $9.90, which implies a potential upside of 51.2%. Its consensus target price has seen a downward revision of 53.0% in 2017 so far.

Returns for TAHO

Tahoe Resources (TAHO) stock has lost 44.1% of its value year-to-date (or YTD) until the end of September. This trend indicates significant underperformance compared to its peers (GDXJ) (RING).

First Majestic Silver (AG), Hecla Mining (HL), Coeur Mining (CDE), and Pan American Silver (PAAS) have returned -10.4%, -4.2%, 1.1%, and 13.1%, respectively, during the same period.

In July 2017, the Guatemalan government suspended the license of Escobal, its flagship mine, for the lack of consultation with the indigenous communities in the area. Although the government reinstated its Escobal mine license on September 10, it is not very encouraging for the investors.

The country’s government has mandated a consultation with the Ministry of Energy and Mines (or MEM) to reinstate the license. Also, the Constitutional Court of Guatemala, its Supreme Court, denied the company’s request to order MEM to renew its export credentials for the year ahead, which more or less makes the mining license useless at the moment.

These developments contributed to Tahoe stock’s significant woes in 2017. The company’s investors are awaiting the decision from the Constitutional Court, which is expected by the end of 2017.

Valuations

Tahoe is trading at a forward EV-to-EBITDA[1. enterprise value to earnings before interest, tax, depreciation, and amortization] multiple of 5.5x, which is a discount of 40.0% compared to its peers. Its multiple has experienced a dramatic hit in 2017 due to the decision regarding the suspension of its flagship mine’s license. Any positive decision on the mine would be a powerful catalyst for the stock.