Are North Korea Tensions Continuing to Affect Precious Metals?

All the four precious metals saw an up day on Monday, October 9, 2017.

Oct. 11 2017, Published 3:04 p.m. ET

Precious metals rebound

All the four precious metals saw an up day on Monday, October 9, 2017. Gold has rebounded from its two-month low on Friday, October 6, to reach $1,285.7 an ounce to close at $1,283.2. Gold futures for November expiration managed a gain of 0.79% for the day. Silver also climbed 1.1% and closed at $17 per ounce. Platinum rose 0.16% and ended at $916.4 per ounce. Palladium rose 0.98% and closed at $929.4 per ounce. Overall, the last five trading days have been beneficial for the precious metals, but they continue to post a loss on a 30-day trailing basis.

The rise in these loved metals was most likely due to North Korea tensions resurfacing. North Korea’s leader Kim Jong Un said his nuclear weapons were a “powerful deterrent” that guaranteed its sovereignty. Some believe that North Koreans may be preparing for another missile test, which could make safe-haven assets rise.

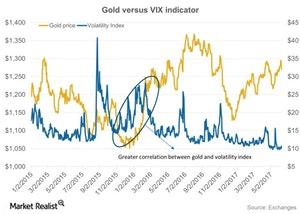

Volatility and gold

The above chart shows how gold (IAU) (SGOL) has reacted to the unrest in the markets over the past couple of years. The turmoil in the market is predicted by the Volatility Index or VIX (VXZ) (VIXY).

Investors can expect precious metal prices to rise more if North Korean tensions worsen. The Fed’s hawkish tone and the subsequent dollar gains have hurt precious metal prices over the past one month.

Precious metals and mining shares are also known to react positively when market tensions rise. Some of the mining stocks that have seen an increase in their price over the past five trading days include Royal Gold (RGLD), Goldcorp (GG), Silver Wheaton (SLW), and Franco-Nevada (FNV). These stocks have risen 3.3%, 1.9%, 3.5%, and 3.1%, respectively, on a five-day trailing basis.