The Idea behind Economic Moats

“How Moats Translate into Sustainable Competitive Advantages” is a five-part moat investing education series that explores the primary sources of economic moats. she

Nov. 20 2020, Updated 11:29 a.m. ET

VanEck

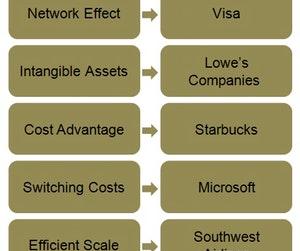

“How Moats Translate into Sustainable Competitive Advantages” is a five-part moat investing education series that explores the primary sources of economic moats. The idea of an economic moat refers to how likely a company is to keep competitors at bay for an extended period. According to Morningstar Equity Research, there are five key attributes that can give companies economic moats, and which are viewed as sources of sustainable competitive advantages: 1) Network Effect; 2) Intangible Assets; 3) Cost Advantage; 4) Switching Costs; and 5) Efficient Scale. Here we explore the concept of the “Switching Costs.”

Market Realist

Idea behind economic moats

“Economic moats” is a term coined and popularized by Warren Buffet. Morningstar assists investors in identifying companies with economic moats or, in other words, companies with a competitive advantage. Obtaining economic moats describes a company’s ability to have a competitive edge over competitors.

Moat companies (MOAT)(VFC)(LB) are determined and chosen with the help of three economic ratings—none, narrow, and wide—assigned by Morningstar.

Morningstar assigns a company a “wide” or “narrow” rating only if it earns above-average returns on capital and protects long-term returns. It assigns ratings to carefully chosen companies that make and sustain profits over the long run while creating value for shareholders.

There are five sources to obtain economic moats, according to Morningstar: network effect, intangible assets, cost advantage, switching costs, and efficient scale. The chart above shows examples of companies that have obtained a competitive edge or an economic moat through these sources. Lowe’s Companies (LOW) received a “wide economic moat” rating, benefitting from several intangible assets. Visa (V) created a competitive advantage through its network effect. Starbucks (SBUX) obtained a “wide” rating through intangible asset and cost advantages.

This series focuses on one of the sources—switching costs. With the examples of four companies, we’ll explore how switching costs helped them obtain economic moats.