How Strongly Can North Korea Move the Precious Metals Market?

Gold futures for September expiration have risen ~3.9% over the past one-month period. Silver, platinum, and palladium have followed the same track as gold.

Sept. 6 2017, Updated 7:38 a.m. ET

North Korean and Russian pressure

Much of the influence on precious metals over the past few weeks has been due to geopolitical tension. The concerns over the nuclear tests in North Korea has caused a rise in gold, which is a primary haven asset. Investors often observe a surge in demand for precious metals as market risk rises.

Gold futures for September expiration have risen ~3.9% over the past one-month period. Silver, platinum, and palladium have followed the same track as gold. These three metals rose 5.7%, 6.2%, and 9.8%, respectively, over the past 30 trading days.

On Friday, September 1, the US ordered that the San Francisco consulate and two other facilities in New York City and Washington, DC, be closed. The Russian foreign ministry called these closures a “blatantly hostile act.” On September 3, Russia urged the return of its three diplomatic facilities in the United States.

Market volatility

Precious metals, especially gold (IAU), are highly reactive to such global news. Market participants often turn their backs on riskier assets and embrace safe-haven assets like gold, silver (SLV), and bonds.

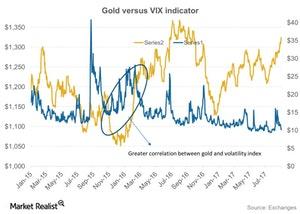

The chart above illustrates the comparative performance of gold with the Volatility Index, VIX (VXZ) (VIXY). VIX is a good way to measure the overall risk element in the market. These two indicators usually diverge from each other.

Gold mining companies tend to be negatively related to market risk. The mining shares that have increased over the past one-month period include Alamos Gold (AGI), Goldcorp (GG), Gold Fields (GFI), and Sibanye Gold (SBGL). These miners have increased 17.4%, 5.2%, 10.7%, and 22.7%, respectively, on a 30-day trailing basis. Combined, these four miners make up ~14.5% of the VanEck Vectors Gold Miners ETF (GDX).