How Record US Crude Oil Exports Are Impacting Crude Oil Inventories and Prices

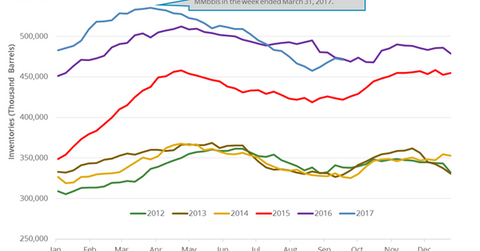

On September 27, the EIA released its weekly report, estimating that US crude oil inventories fell to 470.9 MMbbls from September 15–22, 2017.

Oct. 2 2017, Updated 1:36 a.m. ET

Crude oil inventories

On September 27, 2017, the EIA (US Energy Information Administration) released its Weekly Petroleum Status Report, estimating that US crude oil inventories fell 1.8 MMbbls (million barrels) to 470.9 MMbbls from September 15–22, 2017. US crude oil inventories have fallen 1.1 MMbbls, or 0.2% YoY (year-over-year).

The market expected US crude oil inventories to rise 3.4 MMbbls from September 15–22, 2017, but a surprise draw in US crude oil inventories supported WTI (West Texas Intermediate) crude oil (USO) (UWT) (UCO) prices on September 27, 2017.

Brent (BNO) and US crude oil (DBO) (SCO) (DWT) futures are at multi-month highs due to several bullish drivers, and higher crude oil has a positive impact on oil and gas producers (XLE) (XOP) like Bill Barrett (BBG), Hess (HES), and Goodrich Petroleum (GDP).

US refinery crude oil demand, imports, and exports

US refinery crude oil demand rose 1.002 MMbpd (million barrels per day) to 16.174 MMbpd from September 15–22, 2017. US refinery demand fell 160,000 bpd, or 1% YoY.

US refinery demand fell 20%, or by ~3.6 MMbpd, between August 25, 2017, and September 8, 2017, due to Hurricane Harvey in Texas.

US crude oil imports rose 59,000 bpd to ~7.4 MMbpd from September 15–22, 2017, but US crude oil imports fell 408,000 bpd, or 5.5% YoY.

US crude oil exports rose 563,000 bpd, or 60.6%, to 1.5 MMbpd from September 15–22, 2017. Exports rose 984,000 bpd, or 194% YoY.

Record US crude oil exports and the rise in refinery demand led to the fall in US crude oil inventories. However, the rise in US crude oil production and imports limited the draw in inventories.

Impact of US crude oil inventories

US crude oil inventories fell for the first time four weeks. Although they’re within their five-year range, they’re above their five-year average by 24.6% for the week ending September 22, 2017. High US crude oil inventories could weigh on crude oil (USL) (DTO) prices.

In the next part, we’ll discuss how US crude oil production impacts crude oil prices.