A Look at Mining Stocks’ Correlation with Gold

Miners’ correlation with gold In this part, we’ll look at mining stocks’ correlation with precious metals by comparing their price movement. Specifically, we’ll analyze Alamos Gold (AGI), First Majestic Silver (AG), B2Gold (BTG), and Royal Gold (RGLD). The mining stocks have recovered in the past few weeks. The Direxion Daily Gold Miners Bull 3x Shares […]

Sept. 7 2017, Updated 4:06 p.m. ET

Miners’ correlation with gold

In this part, we’ll look at mining stocks’ correlation with precious metals by comparing their price movement. Specifically, we’ll analyze Alamos Gold (AGI), First Majestic Silver (AG), B2Gold (BTG), and Royal Gold (RGLD).

The mining stocks have recovered in the past few weeks. The Direxion Daily Gold Miners Bull 3x Shares ETF (NUGT) and the ProShares Ultra Silver ETF (AGQ) rose 13.4% and 4.8%, respectively, on a trailing-five-day basis.

Correlation trends

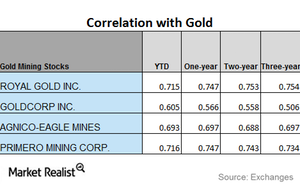

Among the miners we’re focusing on, Alamos has the lowest correlation with gold, while Royal Gold has the highest. A rise in correlation indicates that gold price fluctuations could cause mining stocks to trade in the same direction. The gold correlation of all stocks but Alamos is following a downward trend.

Royal Gold has a three-year correlation of ~0.75 with gold and a year-to-date correlation of ~0.72, which suggests that the stock has moved in the opposite direction as gold almost 72.0% of the time.