Will US Crude Oil Futures Rise above $50 per Barrel This Week?

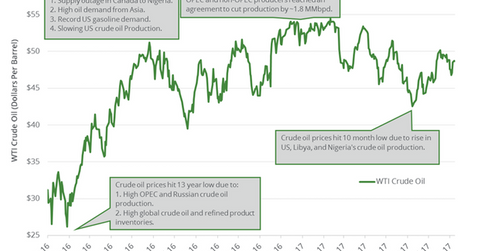

US active crude oil (PXI) (ERY) (FXN) futures hit $26.21 per barrel on February 11, 2016—the lowest level in more than 13 years.

Nov. 20 2020, Updated 2:29 p.m. ET

Energy calendar this week

Let’s track some important events for oil and gas traders on August 14–18, 2017.

- August 22 – the American Petroleum Institute will release its weekly crude oil inventory report.

- August 23 – the EIA (U.S. Energy Information Administration) will release its weekly crude oil and gasoline inventory report.

- August 24 – the EIA will release its weekly natural gas storage report.

- August 25 – Baker Hughes will release its weekly US crude oil and natural gas rig count report.

High and low

US active crude oil (PXI) (ERY) (FXN) futures hit $26.21 per barrel on February 11, 2016—the lowest level in more than 13 years. On the other hand, prices hit $54.45 per barrel on February 23, 2017—the highest level in more than 24 months. Lower crude oil prices have a negative impact on oil and gas producers. The energy sector’s top losers as of August 18, 2017, are mentioned below.

- Zion Oil & Gas (ZN) fell 7.3% to 2.7.

- Hallador Energy (HNRG) fell 5.4% to 5.4.

- Chesapeake Granite Wash (CHKR) fell 4.1% to 2.4.

- Energy XXI (EXXIQ) fell 3.4% to 10.4

- Contango Oil & Gas (MCF) fell 3.1% to 4.68.

Crude oil futures

US crude oil (IXC) (IYE) prices are near a two-week high. Prices could rise above $50 per barrel due to the following:

- There’s an expectation of higher compliance for OPEC’s output cut deal.

- There’s an expectation of a fall in OPEC’s crude oil exports in August 2017.

- US crude oil inventories could fall this week.

Crude oil price forecasts

Energy Aspects, a market intelligence company, thinks that US crude oil prices should be 10% higher from the levels as of August 18, 2017. It suggests that prices should trade at ~$52 and $54 per barrel. Rising demand and falling US crude oil inventories should drive crude oil prices higher.

In the next part of this series, we’ll see how Cushing crude oil inventories impact prices.