How Does the US Dollar Index Influence Crude Oil Prices?

Crude oil and the US Dollar Index are inversely related. The appreciation of the US dollar will negatively influence crude oil prices.

Nov. 5 2015, Updated 9:52 a.m. ET

US Dollar Index and crude oil

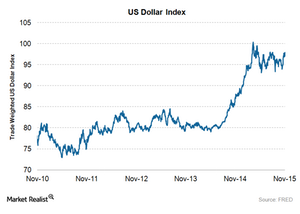

The US Dollar Index rose by 4% against the basket of currencies in the last 15 trading sessions. The US dollar rose due to the speculation that the Fed will increase the interest rate in December 2015. During the same period, US crude oil prices fell almost 3% due to oversupply concerns.

What’s the relationship?

Crude oil and the US Dollar Index are inversely related. The appreciation of the US dollar will negatively influence crude oil prices. On the other hand, the depreciation of the US dollar will positively influence crude oil prices. Why? Crude oil is a globally traded commodity. So, it’s denominated in the US dollar. The volatility in the US dollar impacts the crude oil importer in the domestic currency.

US dollar perspective

The US dollar is expected to appreciate over the long term due to the speculation of the Fed increasing the interest rate. In contrast, the Eurozone, China, India, and Japan are loosening their monetary policy for economic growth. The diverging monetary policy could benefit the US dollar. So, it makes the US dollar an attractive investment vehicle. However, the Fed hasn’t been able to raise the interest rate due to the slowing Chinese and global economy and weak US inflation.

The speculation of the strengthening US dollar will put downward pressure on the crude oil market in the oversupplied market. The depressed oil market will impact oil producers’ margins like Hess (HES), Laredo Petroleum (LPI), and Whiting Petroleum (WLL). In contrast, it benefits US refiners like Valero Energy (VLO) and Phillips 66 (PSX). ETFs like the iShares US Oil Equipment & Services ETF (IEZ) and the PowerShares DWA Energy Momentum ETF (PXI) are also affected by the ups and down in the crude oil market.

In the next part, we’ll discuss the latest oil price forecast.