Natural Gas: Analyzing the Futures Spread

On August 30, 2017, natural gas October 2018 futures traded at a discount of ~$0.03 to October 2017 futures.

Aug. 31 2017, Updated 3:06 p.m. ET

Futures spread

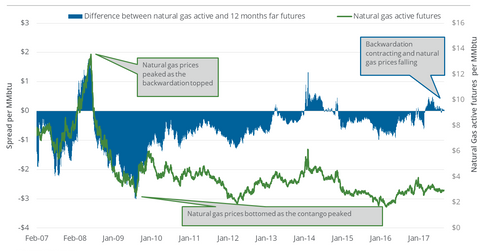

On August 30, 2017, natural gas October 2018 futures traded at a discount of ~$0.03 to October 2017 futures. On August 23, 2017, the discount between the futures contract was at $0.04. Between these two dates, natural gas prices fell 0.7%.

Discount

When the futures spread is at a discount or the discount rises, natural gas prices usually rise. On May 12, 2017, natural gas active futures settled at the highest closing price in 2017. On the same day, the discount rose to $0.5. When the discount falls, it’s associated with weak prices.

Premium

When the futures spread is at a premium or the premium rises, natural gas prices usually fall. On February 21, 2017, natural gas active futures settled at the lowest closing price in 2017. On the same day, the premium rose to ~$0.6.

So, the natural gas futures spread can be important for natural gas traders. It helps traders anticipate a possible shift in the supply-demand dynamics. In the trailing week, the discount between the two futures contracts fell and so did natural gas prices. Concerns about a demand-supply imbalance due to Hurricane Harvey could have caused the discount to fall.

Energy stocks

The natural gas futures spread is vital to:

- US natural gas producers (XOP) (DRIP) (IEO) for their hedging decisions

- Midstream companies’ (AMLP) natural gas storage and transportation businesses

The spread between natural gas October 2017 and November 2017 futures contracts could be vital for the United States Natural Gas Fund (UNG).

Read Market Realist’s upstream premier to learn more about upstream stocks.