Assessing Gold Miners’ Capacity to Repay Debt through Earnings

Yamana Gold’s (AUY) net-debt-to-forward EBITDA ratio is 2.8x, which is higher than its peers’ ratios.

Aug. 21 2017, Updated 7:36 a.m. ET

Net debt-to-EBITDA

It isn’t always a bad situation to have debt if the company has the ability to repay it through its earnings. We can gauge this repayment capacity for miners by using certain ratios.

The net-debt-to-EBITDA[1. earnings before interest, tax, depreciation, and amortization] ratio is one such measure, which indicates how many years it would take for a company to repay its debt if its net debt and EBITDA stay constant. Net debt is calculated as total debt minus cash and cash equivalents.

A lower ratio is better for a company. It’s usually better to use forward EBITDA, as investors concentrate on future earnings potential rather than the trailing earnings capacity.

Repayment capacity

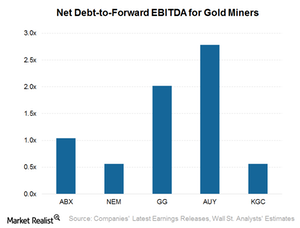

The chart above shows this ratio for the miners under discussion. Yamana Gold’s (AUY) net-debt-to-forward EBITDA ratio is 2.8x, which is higher than its peers’ ratios. Barrick Gold and Goldcorp (GG) have net-debt-to-forward EBITDA ratios of ~1.0x and ~2.0x, respectively.

Newmont Mining (NEM) and Kinross Gold (KGC) are on par with respect to this ratio at 0.56x each. These two companies seem to be comfortably placed as far as their repayment capacity is concerned.

Because this ratio is based on a company’s future earnings capacity, a change in guidance or any new flow would impact this ratio. As a result, this ratio could change quickly to depict the latest analyst earnings estimates.

Together, Newmont Mining (NEM) and Barrick Gold (ABX) comprise ~19% of the VanEck Vectors Gold Miners ETF (GDX). Leveraged ETFs like the ProShares Ultra Silver ETF (AGQ) and the Direxion Daily Gold Miners Bull 3X ETF (NUGT) also provide leverage to precious metal prices. However, they carry a higher risk than nonleveraged ETFs such as the SPDR Gold Shares ETF (GLD).

Next, let’s move to an analysis of the free cash flow upsides for our four senior gold mining companies.