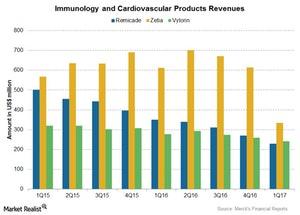

Merck’s Immunology and Cardiovascular Franchise in 1Q17

The combined revenues for Zetia and Vytorin fell 35% to $575 million in 1Q17, compared to $889 million in 1Q16.

July 5 2017, Updated 7:35 a.m. ET

Immunology franchise

Merck & Co.’s (MRK) Immunology franchise includes Remicade and Simponi. Remicade is one of the top-selling drugs for the treatment of inflammatory disorders, while Simponi is a once-monthly subcutaneous treatment. Both drugs reported a decline in revenues during 1Q17.

Remicade

Remicade’s revenues fell ~34% to $229 million in 1Q17, compared to $349 million for 1Q16. This decline was due to the entry of generic competition and biosimilars following the loss of exclusivity of Remicade in the European markets in February 2015. Merck expects Remicade’s revenues to continue their declines, as new patients prefer biosimilars over Remicade.

While Merck has the marketing rights for Remicade in the European markets, Johnson & Johnson (JNJ) holds marketing rights of Remicade in several countries outside Europe.

Simponi

Simponi’s revenues fell to $184 million in 1Q17, compared to $188 million in 1Q16.

Cardiovascular franchise

Merck’s Cardiovascular franchise includes the blockbuster drugs Zetia and Vytorin. These drugs are used for lowering the LDL cholesterol levels in the blood of patients with a high risk of cardiovascular disease.

The combined revenues for Zetia and Vytorin fell 35% to $575 million in 1Q17, compared to $889 million in 1Q16. Zetia competes with AbbVie’s (ABBV) Niaspan and Pfizer’s (PFE) Lipitor.

To divest company-specific risks, investors can consider the iShares Core High Dividend ETF (HDV), which holds ~3.5% of its total assets in Merck. HDV also holds 4.9% in Pfizer (PFE) and 1.5% in Eli Lilly & Co. (LLY).