Why the Inventory Spread Could Make Natural Gas Bulls Happy

On a week-over-week basis, natural gas inventories rose by 75 Bcf (billion cubic feet) and were at 2,444 Bcf for the week ended May 19, 2017.

June 1 2017, Updated 3:56 p.m. ET

Natural gas inventories rose

On a week-over-week basis, natural gas inventories rose by 75 Bcf (billion cubic feet) and were at 2,444 Bcf for the week ended May 19, 2017, according to an EIA report on May 25, 2017.

How natural gas inventories impact prices

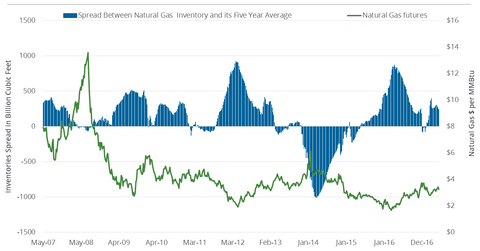

Natural gas prices closely follow the natural gas inventories spread but in an inverse manner. Because of seasonality, the spread between natural gas inventories and their five-year average is more important.

Since 2007, natural gas inventories above the five-year average could be responsible for the fall in natural gas. In contrast, between December 2013 and April 2014, when inventory levels were below their five-year average, natural gas (BOIL) (GASL) prices rose to $6.14 per million British thermal units.

What recent natural gas inventories suggest

In the week ended January 27, 2017, natural gas inventories moved above their five-year average. Since then, natural gas futures have lost 9.4%. In the most recent week, natural gas inventories were 10.9% above their five-year average. However, in the previous week, inventories were 12.1% above their five-year average. This fall in the spread along with the fact that inventories were 13.2% below last year’s level could support natural gas prices.

Natural gas prices can impact the following ETFs:

Market estimates for natural gas inventory

On June 1, 2017, the EIA reported natural gas inventories for the week ended May 26, 2017. Analysts predicted natural gas inventories could rise by 78 Bcf.