What’s in the Natural Gas Inventory Spread—Bears?

In the week ended June 2, 2017, natural gas inventories rose by 106 Bcf.

June 15 2017, Published 10:34 a.m. ET

Natural gas inventories

In the week ended June 2, 2017, natural gas inventories rose by 106 Bcf (billion cubic feet). Natural gas inventories were at 2,631 Bcf according to the EIA (US Energy Information Administration) data released on June 8, 2017.

Natural gas prices and inventory spread

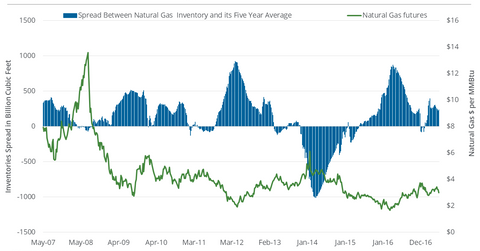

In the last decade, any rise in the natural gas inventories spread has impacted natural gas prices negatively. In fact, since 2008, the downturn in natural gas prices can be linked to higher inventory spreads.

During the 2013–2014 winter season, the inventories spread reversed. Natural gas (GASL) prices rose to $6.15 per million British thermal units—the highest closing price since December 4, 2008.

Notably, these factors could impact energy ETFs like the ProShares Ultra Oil & Gas ETF (DIG), the Vanguard Energy ETF (VDE), the Direxion Daily S&P Oil & Gas Exploration & Production Bear 3x ETF (DRIP), the iShares US Energy ETF (IYE), and the SPDR S&P Oil & Gas Exploration & Production ETF (XOP).

The natural gas inventories spread last week

Natural gas inventories moved above their five-year average in the week ended January 27, 2017. Since then, natural gas active futures have fallen 13.5%.

In the week ended June 2, 2017, natural gas inventories were 9.9% above their five-year average, as compared to 9.8% in the previous week. On a week-over-week basis, the natural gas inventory spread has risen. Natural gas active futures tumbled 2.9% between June 7 and June 14, 2017.

However, natural gas inventories fell 11.2% on a YoY (year-over-year) basis, according to the recent data. On a YoY basis, natural gas active futures have risen 12.6% as of June 14, 2017. Inventories below last year’s levels could limit the downside in natural gas prices.

The EIA will release natural gas inventory data for the week ended June 9, 2017, on June 15, 2017. Analysts’ forecasts suggest a rise of 88 Bcf in natural gas inventories.