US Gasoline Demand: Positive or Negative for Crude Oil?

The EIA (U.S. Energy Information Administration) estimates that weekly US gasoline demand rose by 547,000 bpd or 6% to 9,816,000 bpd on June 9–16, 2017.

June 28 2017, Published 11:17 a.m. ET

US gasoline demand

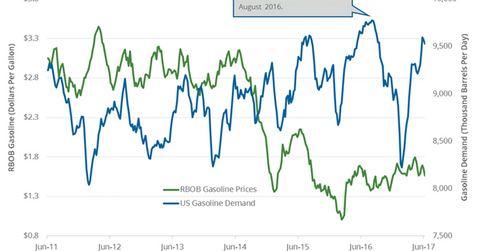

The EIA (U.S. Energy Information Administration) estimates that weekly US gasoline demand rose by 547,000 bpd (barrels per day) or 6% to 9,816,000 bpd on June 9–16, 2017. Weekly gasoline demand was near this level at the same time in 2016.

Four-week average US gasoline demand rose by 28,000 bpd (barrels per day) or 0.3% to 9,556,000 bpd on June 9–16, 2017. Four-week average US gasoline demand is 1.6% lower than the same period in 2016.

The year-over-year fall in gasoline demand would have a negative impact on gasoline and crude oil (ERY) (ERX) (FENY) prices.

Lower gasoline and crude oil prices are negative for refiners and oil and gas exploration and production companies’ profitability like Western Refining (WNR), Marathon Petroleum (MPC), Carrizo Oil & Gas (CRZO), and Cobalt International Energy (CIE).

Gasoline exports

The EIA expects that US gasoline exports have risen 125% since 2010. The rise in gasoline exports supports US gasoline demand. Mexico is the key US gasoline importer. US exports to Mexico accounted for 53% of US gasoline exports in 2016.

US gasoline consumption estimates

The EIA thinks that US gasoline consumption will average 9,340,000 bpd in 2017. US gasoline consumption is expected to average 9,370,000 bpd in 2018. US gasoline consumption could hit a record in 2018. US gasoline consumption averaged 9,330,000 bpd in 2016.

Gasoline demand drivers

A record number of US travelers this summer would drive gasoline demand. Record gasoline demand would support gasoline prices this summer. High gasoline prices would also drive crude oil demand and prices.

In the next part, we’ll discuss Asia’s crude oil demand.