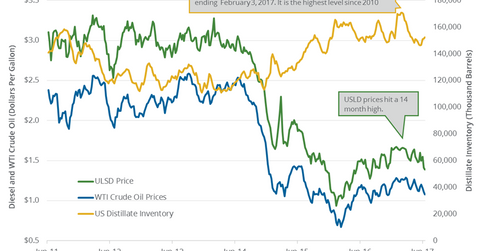

US Distillate Inventories Rose for the Fourth Straight Week

US distillate inventories rose by 1.1 MMbbls to 152.5 MMbbls on June 9–16, 2017. US distillate inventories rose for the fourth consecutive week.

Nov. 20 2020, Updated 11:49 a.m. ET

US distillate inventories

The U.S. Energy Information Administration released its weekly petroleum status on June 21, 2017. It reported that US distillate inventories rose by 1.1 MMbbls (million barrels) to 152.5 MMbbls on June 9–16, 2017. US distillate inventories rose for the fourth consecutive week. Inventories rose by 6.1 MMbbls or 4% in the last four weeks.

Diesel futures fell 2.2% to $1.36 per gallon on June 21, 2017. The larger-than-expected rise in distillate inventories pressured diesel and crude oil (XLE) (USL) (PXI) futures on June 21, 2017.

Lower crude oil and diesel prices have a negative impact on US refiners and crude oil producers’ profitability like Valero (VLO), Sanchez Energy (SN), and Northern Oil & Gas (NOG).

US distillate production, import, and demand

US distillate production rose 1.8% to 5,251,000 bpd (barrels per day) on June 9–16, 2017. Production rose 5.6% from the same period in 2016.

US distillate imports rose by 26,000 to 87,000 bpd on June 9–16, 2017. Imports fell 40% from the same period in 2016.

US distillate demand rose 2.8% to 4,158,000 bpd on June 9–16, 2017. Demand rose 6.5% from the same period in 2016.

Impact

US distillate inventories are above the five-year range. High distillate inventories would pressure diesel and crude oil futures.

For more on crude oil’s price forecast, read US and Brent Crude Oil Price Forecast for the Next 6 Months.

To learn more about crude oil, read Is It the New Bear Market for WTI and Brent Crude Oil? and Crude Oil Prices Could Collapse despite OPEC’s Production Cut.

Read Will US Natural Gas Bulls Overshadow the Bears? for more on natural gas prices.