Chart in Focus: The Natural Gas Inventory Spread

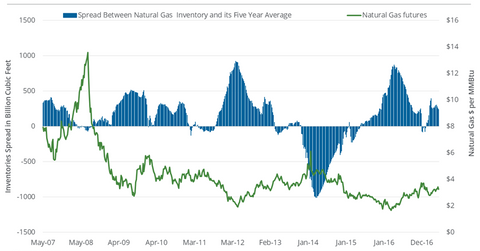

Between January 27–June 7, 2017, natural gas active futures fell 10.9%. Natural gas inventories moved above their five-year average in the week ended January 27, 2017.

June 9 2017, Updated 7:37 a.m. ET

Natural gas inventory

Between May 19–May 26, 2017, natural gas inventories rose by 81 Bcf (billion cubic feet) and stood at 2,525 Bcf, based on EIA data released on June 1, 2017.

Natural gas inventories spread

Natural gas prices are inversely related to the natural gas inventories spread. Because of seasonality, the spread between natural gas inventories and their five-year average is more important, as shown in the chart above.

Since 2007, natural gas prices have been in a downturn. During this period, natural gas inventories were above their five-year average. However, during the 2103–2014 winter season, natural gas inventories fell below their five-year average. Natural gas (GASL) active futures rose to $6.14 per million British thermal units (or MMBtus).

This relationship could be important for the following ETFs:

Recent move in natural gas inventories spread

Between January 27–June 7, 2017, natural gas active futures fell 10.9%. Natural gas inventories moved above their five-year average in the week ended January 27, 2017.

In the week ended May 19, 2017, natural gas inventories were 10.9% above their five-year average. In the week ended May 26, natural gas inventories were 9.8% above their five-year average. So, on a week-over-week basis, the natural gas inventories spread fell. On a year-over-year basis, natural gas inventories fell 12.8%. These two factors could support natural gas prices.

On June 8, 2017, the EIA is scheduled to release its natural gas inventory data for the week ended June 2, 2017. Based on analyst estimates, natural gas inventories could rise 99 Bcf in the week ended June 2, 2017.