Natural Gas Prices Driving Chesapeake Energy Stock in 2017

Chesapeake Energy’s (CHK) 2016 debt management efforts included a combination of debt exchanges, open market repurchases, and equity-for-debt exchanges.

Dec. 4 2020, Updated 10:53 a.m. ET

Chesapeake Energy stock

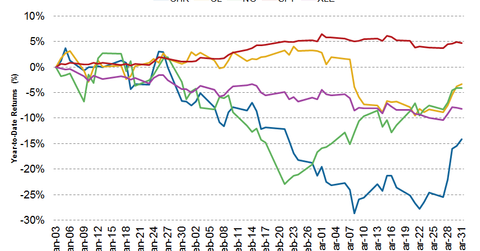

Chesapeake Energy (CHK) stock has continued its upward momentum tracking natural gas (UNG) (UGAZ) prices higher, as we can see in the chart below. Since the beginning of the year, CHK stock has declined significantly. However, the current trend shows that the stock has recovered from its previous lows and is heading toward the levels seen at the beginning of 2017.

Chesapeake Energy (CHK) stock has fallen ~14% since the beginning of 2017. Natural gas prices have fallen ~4.1% since the beginning of the year. CHK has also underperformed the Energy Select Sector SPDR ETF (XLE), which has returned approximately -8.2% year-to-date. The S&P 500 ETF (SPY) has returned ~4.7% during the same period.

Improving energy prices

While Chesapeake Energy has underperformed both the energy sector and natural gas prices, its gains in the last two weeks have been significant. Its stock increased 12% in the last two weeks.

As oil prices have also been rising, Chesapeake Energy should again benefit in terms of price realizations in a sustained increasing or bullish oil price environment. Our series CHK Survived the Odds in 2016, but Can Investors Relax Now? noted that oil growth should drive CHK’s production growth in 2017 and 2018.

Improving commodity prices should be imperative for the company’s key strategy to lower its debt. CHK continues to struggle under a huge debt load despite the various efforts it has made in previous years.

Chesapeake Energy’s (CHK) 2016 debt management efforts included a combination of debt exchanges, open market repurchases, and equity-for-debt exchanges. Asset sales were another key strategy that CHK used to reduce its debt. For more information, please read Inside Chesapeake Energy’s Debt Management Efforts in 2016.