A Look at Mining Stocks’ Correlation with Gold in 2017

Mining stocks and precious metals As global tumult grips markets and investors are turning to mining stocks as safe havens, it’s crucial to understand which stocks are closely tied to precious metals. Stocks with a higher correlation with precious metals will likely be impacted more by global indicators that influence precious metals. The Direxion Daily […]

April 20 2017, Updated 12:35 p.m. ET

Mining stocks and precious metals

As global tumult grips markets and investors are turning to mining stocks as safe havens, it’s crucial to understand which stocks are closely tied to precious metals. Stocks with a higher correlation with precious metals will likely be impacted more by global indicators that influence precious metals.

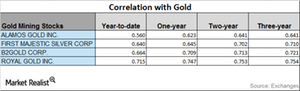

The Direxion Daily Gold Miners Bull 3X ETF (NUGT) and the ProShares Ultra Silver ETF (AGQ) have seen massive YTD (year-to-date) gains of 44.9% and 31.1%, respectively. Among Alamos Gold (AGI), First Majestic Silver (AG), B2Gold (BTG), and Royal Gold (RGLD), Alamos has the lowest correlation with gold, while Royal has the highest correlation with gold. Over the past three years, all four miners have seen their correlation with gold fall. Studying upward and downward trends is important for metal investors, as price change predictability can be affected by rises and falls in precious metal prices.

Upward trending correlations

Alamos Gold’s correlation with gold has dropped from a three-year correlation of ~0.64 to a YTD correlation of ~0.56. A correlation of ~0.56 means that ~56% of the time, Alamos Gold has moved in the same direction as gold. Similarly, if we look at First Majestic Silver, it has seen its correlation drop from a three-year correlation of 0.71 to a YTD correlation of 0.64.

Most mining shares have seen their prices rise due to the revival of precious metals on increased haven bids. Price increases do not indicate an increase in correlation.