Looking at Silver Miners after the Federal Reserve’s Rate Hike

Silver miners (SIL) are usually a levered play on gold. Notably, silver has outperformed gold year-to-date.

March 21 2017, Published 4:08 p.m. ET

Silver miners

Precious metal miners with substantial exposure to silver are usually classified as silver miners. Tahoe Resources (TAHO), Coeur d’Alene Mines (CDE), Hecla Mining (HL), Pan American Silver (PAAS), and First Majestic Silver (AG) make up 7.2% of the VanEck Vectors Gold Miners ETF (GDX).

Please read Silver Miners in 2017: Which Offer the Most Value? for an in-depth analysis of silver miners.

Silver-levered play on gold

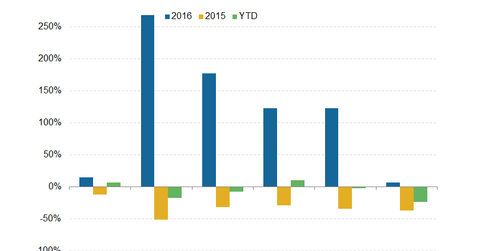

Silver miners (SIL) are usually a levered play on gold. Notably, silver has outperformed gold year-to-date. While gold prices rose 8% in 2016, silver prices (SLV) rose 15%. This leverage could work to the downside if gold prices come under prolonged pressure after the Fed’s rate hike.

Silver miners after the rate hike

However, the divergence between silver prices and silver miners’ stock prices has continued due to company-specific factors and the leveraged nature of these companies.

Most of the silver miners have fallen year-to-date. Tahoe Resources (TAHO) fell 24% through March 16, 2017. Coeur d’Alene Mines (CDE) followed with a fall of 18% while Hecla Mining (HL) and First Majestic Silver (AG) fell 8% and 2%, respectively. Only Pan American Silver (PAAS) has gained, rising 10%.

Tahoe Resources stock has been under pressure in 2017 after it gave a disappointing guidance on January 5, 2017. Its guidance was lower than expected for production, whereas its costs and capex were on the higher side. Several analysts cut their target prices for the miner on weaker-than-expected guidance. In a weaker precious metal environment, it can come under renewed pressure.

As a high-cost operator, Coeur d’Alene Mines’s operational leverage is the major reason for its underperformance. In a weaker precious metal price scenario, this stock could come under pressure due to its higher costs. To learn more about Coeur Mining’s performance and outlook, please read Coeur Mining’s Stock Price Strength into the Year End and Beyond.

Hecla Mining missed its earnings expectations for 4Q16, which led to pressure on its stock price. However, its growth profile looks strong as it has decided to advance its Rock Creek and Montanore mines. These initiatives should provide the company with the next leg of growth as it is also focusing on reducing costs.

Pan American Silver beat its 4Q16 forecasts, making it the only silver stock to have gained YTD.

Coeur d’Alene Mines and First Majestic Silver are highly leveraged operations in relation to their closest peers. They’re also rather high-cost operators, which can lead to disproportionate gains.

If you’re looking for a long-term, high-quality company, you could also look at Tahoe Resources. While its leverages to gold and silver prices are low, it has strong fundamentals.

Please read Silver Miners: Which Stocks Could Offer Upside Potential? for an in-depth look at these silver miners. The ProShares Ultra Silver ETF (AGQ) is another way of getting leveraged exposure to silver prices for risk-tolerant investors.

In the final part of this series, we’ll take a look at what’s driving South African precious metal miners.