Analyzing Libya’s Crude Oil Production

A Reuters survey estimates that Libya’s crude oil production fell by ~20,000 bpd (barrels per day) to 670,000 bpd in February 2017—compared to January 2017.

Nov. 20 2020, Updated 5:13 p.m. ET

Libya’s crude oil production

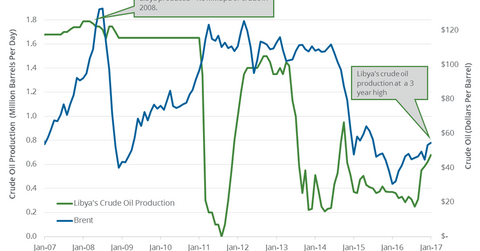

A Reuters survey estimates that Libya’s crude oil production fell by ~20,000 bpd (barrels per day) to 670,000 bpd in February 2017—compared to January 2017. Libya’s crude oil production hit 690,000 bpd in January 2017—the highest level in the last three years. The rise in crude oil production from Libya could pressure crude oil (USL) (IEZ) (RYE) (PXI) prices. For more on crude oil prices and drivers, read Part 1 of this series.

Libya is a member of OPEC (Organization of the Petroleum Exporting Countries). The EIA (U.S. Energy Information Administration) estimates that Libya’s crude oil production rose by 58,000 bpd to 678,000 bpd in January 2017—compared to the previous month. Production rose 9.4% month-over-month and 83% year-over-year.

Libya’s crude oil production estimates

Libya produced ~1.8 MMbpd (million barrels per day) of crude oil in 2008. Civil war and militant attacks on the country’s oil infrastructure caused the fall in Libya’s crude oil production.

On February 16, 2017, Libya’s National Oil Corporation reported that the country could produce 1.25 MMbpd of crude oil by the end of August 2017 if all of the blockades on its ports are cleared. However, Libya is prone to political turmoil and security concerns.

The fall in Libya’s crude oil production after 2010 was one of the factors that kept global crude oil prices elevated until mid-2014.

Libya’s crude oil exports

On December 19, 2016, Libya’s biggest port, Es Sider, reopened after two years. It had been shut down due to militant attacks. Es Sider’s capacity before the militant attacks was at 350,000 bpd. However, militant attacks in early March 2017 caused Es Sider and Ras Lanuf to shut down. It could lead to drop in Libya’s crude oil production to as low as 650,000 bpd from its current production of ~700,000 bpd, according to Bloomberg reports.

The drop in exports and production from Libya could boost crude oil (SCO) (DIG) prices. Higher crude oil prices could have a positive impact oil producers such as ExxonMobil (XOM), Devon Energy (DVN), and Laredo Petroleum (LPI).

Read Will Crude Oil Prices Test 3 Digits Again? for more on crude oil price forecasts.

Read What Can Investors Expect in the Crude Oil Market in 2017 and Are Hedge Funds Reacting to the Crude Oil Market? for more on crude oil prices.

For related analysis, visit Market Realist’s Energy and Power page.