How Did Parsley Energy’s Stock React to Acquisition News?

Parsley Energy’s (PE) latest acquisition news came after markets closed on February 7, 2017.

Feb. 9 2017, Updated 10:37 a.m. ET

Parsley Energy’s stock reaction

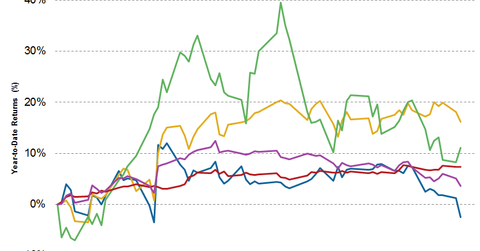

Parsley Energy’s (PE) latest acquisition news came after markets closed on February 7, 2017. The stock closed 3.6% lower on February 7. The drop in Parsley’s stock likely has more to do with weakness in crude oil prices on Tuesday. Crude oil prices fell ~1.6% on Tuesday after the American Petroleum Institute reported that crude inventories increased significantly more than expected last week. The energy sector as a whole experienced weakness, dropping 1.4% on Tuesday.

We notice that PE stock had been rallying in late November, mirroring crude oil prices. Crude oil prices were on an uptrend after OPEC (Organization of Petroleum Exporting Countries) finally agreed to production cuts after a lot of dilly-dallying in late November 2016. However, increasing crude stockpiles in the US have offset these gains.

In the three months since November, PE fell ~2.5%, underperforming the XLE as well as the broader market S&P 500 ETF (SPY) (SPX-INDEX) (ONEQ) (COMP-INDEX). Year-over-year, PE has increased ~104%, outperforming the broader market (DIA) (DJIA-INDEX) and energy sector XLE ETF (XLE), which increased by 21% and 28%, respectively, in the same period.