What Are Analysts’ Recommendations for Merck in 2017?

For 2016, Merck & Co. (MRK) reported revenue close to $39.8 billion, a year-over-year (or YoY) rise of ~1%. New product launches have played major roles in boosting Merck’s 2016 revenue.

Dec. 4 2020, Updated 10:53 a.m. ET

Financial performance in 2016

For 2016, Merck & Co. (MRK) reported revenue close to $39.8 billion, a year-over-year (or YoY) rise of ~1%. Excluding negative impact of unfavorable foreign exchange fluctuations, the company reported YoY revenue growth of ~3% in 2016. New product launches such as those of Keytruda, Bridion, and Zepatier have played major roles in boosting Merck’s 2016 revenue.

While the company faced generic competition for its major brands such as Nasonex, Zetia, and Cubicin in 2016, the negative revenue impact was partly offset by a robust performance of the Januvia franchise, the Vaccines segment, and the Animal Health business.

For 2016, Merck & Co. reported non-generally accepted accounting principles (non-GAAP) earnings per share (or EPS) of ~$3.78, which is YoY growth of ~5%. Owing to optimal resource allocation, in 2016, the company managed to maintain its operating expenses close to those reported in 2015. Hence, in 2016, the company’s higher research and development (or R&D) expenses were partly offset by its falling marketing and administrative expenses.

Analysts’ recommendations for Merck

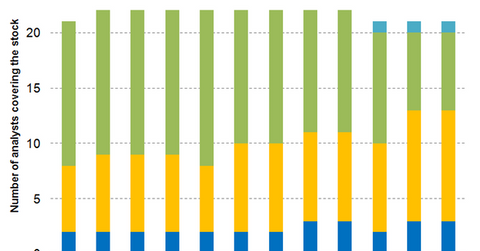

Of the 21 analysts covering Merck & Co. in February 2017, three have rated the company as a “strong buy,” and ten have rated it as a “buy.” Of the 21, seven have rated Merck as a “hold,” while none have rated it as a “sell”. Only one analyst has rated the company as a “strong sell.” Approximately 62% of analysts have given the company some form of “buy” recommendation.

Notably, Merck makes up ~6.4% of the Health Care Select Sector SPDR ETF’s (XLV) total portfolio holdings.

Peer ratings

Of the 22 analysts covering Eli Lilly (LLY) in February 2017, ~77% have rated the company as a “buy.” Approximately 44% of the 23 analysts covering Bristol-Myers Squibb (BMY) have given it “buy” recommendations in February 2017. Further, ~60% of the five analysts covering Novartis (NVS) have rated the company as a “buy” this month.