Global Crude Oil Supply Outages Could Help Crude Oil Bulls

The EIA estimated that global crude oil supply outages rose by 181,000 bpd (barrels per day) to 2.52 MMbpd in April 2017—compared to March 2017.

May 30 2017, Published 8:40 a.m. ET

Global crude oil supply outages

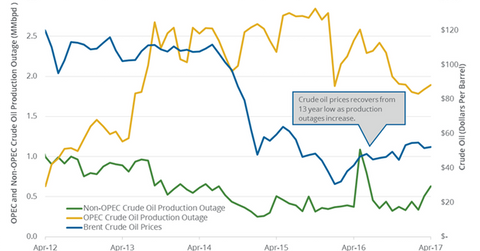

The U.S. Energy Information Administration estimated that global crude oil supply outages rose by 181,000 bpd (barrels per day) to 2.52 MMbpd (million barrels per day) in April 2017—compared to March 2017.

Supply outages rose 7.7% in April 2017—compared to the previous month. However, supply outages fell 10.4% from the same period in 2016. The rise in supply outages could have a bullish impact on crude oil (UCO) (IXC) (DIG) (VDE) prices. Supply outages were at 3.6 MMbpd in May 2016—the highest level since 2011.

- Non-OPEC oil producers’ supply outages rose by 124,000 bpd to 0.63 MMbpd in April 2017—compared to March 2017. Countries like Canada and Yemen had major production outages among non-OPEC producers in April 2017. Canada and Yemen had production outages of 0.42 MMbpd and 0.13 MMbpd, respectively, in April 2017.

- OPEC members’ supply outages rose by 56,000 bpd to 1.89 MMbpd in April 2017—compared to March 2017. Countries like Libya and Nigeria had major production outages among OPEC members in April 2017.

Impact of rising global crude oil supply outages

The decline in global crude oil supplies due to increased production could have a bullish impact on crude oil prices. Higher crude oil prices could have a positive impact on oil and gas producers’ earnings such as Hess (HES), Denbury Resources (DNR), and Goodrich Petroleum (GDP).

In the next part, we’ll discuss some crude oil prices forecasts.