What’s in Store for Silver Miners after the Fed’s Rate Hike?

Silver miners have shown a significant correlation to gold prices, at 0.84 from the start of 2013 to December 14, 2016.

Dec. 16 2016, Updated 3:05 p.m. ET

Silver miners

Precious metal miners with substantial exposures to silver are usually classified as silver miners. Tahoe Resources (TAHO), Coeur Mining (CDE), Hecla Mining (HL), Pan American Silver (PAAS), and First Majestic Silver (AG) make up 7.2% of the VanEck Vectors Gold Miners ETF (GDX).

Silver-levered play on gold

The above group has also shown a significant correlation to gold prices, at 0.84 from the start of 2013 to December 14, 2016. It’s worth noting that silver prices have a strong correlation to gold prices. Gold’s YTD (year-to-date) correlation with silver as of December 14 has also been high at 0.93.

Notably, silver has outperformed gold YTD. While gold prices have risen 6.0%, silver prices (SLV) have risen 21.0%. That’s mainly because silver is usually a levered play on gold prices. This leverage could work to the downside if gold prices come under prolonged pressure after the Fed’s rate hike.

Silver miners after the rate hike

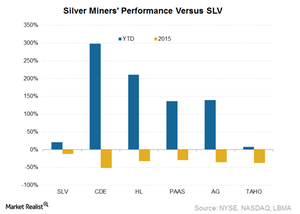

The divergence between silver prices and silver miners’ stock prices, however, has continued due to company-specific factors and the leveraged nature of these companies. Coeur Mining has significantly outperformed its peers, rising 298.0% YTD as of December 14, 2016.

Coeur Mining is highly leveraged operationally compared to its closest peers. It’s a high-cost operator, and its operational leverage is the major reason for its outperformance. In a weaker precious metal price scenario, this stock could come under pressure due to its higher costs.

To learn more about Coeur’s performance and outlook, read Coeur Mining’s Stock Price Strength into the Year End and Beyond.

First Majestic Silver (AG) has risen 139.0% YTD. By comparison, Pan American Silver (PAAS), Hecla Mining (HL), and Tahoe Resources (TAHO) have risen 137.0%, 211.0%, and 8.0%, respectively.

Coeur Mining and First Majestic Silver are highly leveraged operationally compared to their closest peers. They’re also rather high-cost operators, which can lead to disproportionate gains. Coeur Mining took the hardest hit in 2015 when silver prices fell 12.4%. It underperformed its peers, falling 51.5%.

If you’re looking for a long-term, high-quality company, you could also look at Tahoe Resources. While its leverages to gold and silver prices are low, it has strong fundamentals.

Read Silver Miners: Which Stocks Could Offer Upside Potential? for an in-depth look at these silver miners.

The ProShares Ultra Silver (AGQ) is another way of getting leveraged exposure to silver prices for risk-tolerant investors.

In the next part of this series, we’ll take a look at what’s driving South African precious metal miners.