Why Did Kate Spade Stock Rise on December 28?

Kate Spade (KATE) rose more than 23.0% on December 28, 2016, after the report that the company is planning to sell its businesses with the help of investment banker.

Dec. 30 2016, Updated 9:07 a.m. ET

Price movement

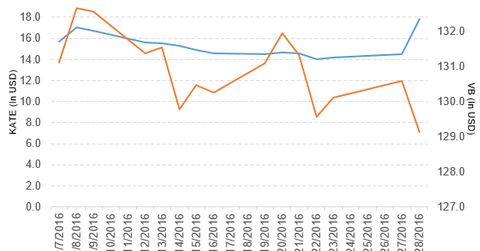

Kate Spade (KATE) has a market cap of $2.3 billion. It rose 23.1% to close at $17.86 per share on December 28, 2016. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were 21.5%, 13.5%, and 0.51%, respectively, on the same day.

KATE is trading 18.3% above its 20-day moving average, 11.7% above its 50-day moving average, and 10.1% below its 200-day moving average.

Related ETF and peers

The Vanguard Small-Cap ETF (VB) invests 0.09% of its holdings in KATE. The YTD price movement of VB was 18.6% on December 28.

The market caps of KATE’s competitors are as follows:

Latest news on KATE

Kate Spade (KATE) rose more than 23.0% on December 28, 2016, after the report that the company is planning to sell its businesses with the help of an investment banker.

According to a December 28 report by Craig Giammona and Stephanie Hoi-Nga Wong, “Shareholder Caerus Investors had pushed the company last month to find an acquirer that could help it improve its profit margins. New York-based Kate Spade is now working with an investment bank and has reached out to potential buyers, Dow Jones reported Wednesday, citing people familiar with the matter.”

The report added, “Kate Spade would be seeking a buyer at an opportune time, with Coach Inc., Michael Kors Holdings Ltd., Calvin-Klein-owner PVH Corp. and Timberland-owner VF Corp. all having said they are looking for acquisitions.”

Performance of Kate Spade in fiscal 3Q16

Kate Spade reported fiscal 3Q16 net sales of $316.5 million—a rise of 14.1% compared to net sales of $277.3 million in fiscal 3Q15. The company’s gross margin narrowed 180 basis points and its operating margin rose 730 basis points in fiscal 3Q16 compared to fiscal 3Q15.

Its net income and EPS (earnings per share) rose to $29.6 million and $0.23, respectively, in fiscal 3Q16 compared to $2.3 million and $0.02, respectively, in fiscal 3Q15.

Kate Spade’s cash and cash equivalents and inventories rose 40.2% and 5.7%, respectively, in fiscal 3Q16 compared to fiscal 3Q15. Its current ratio rose to 2.8x and its debt-to-equity ratio fell to 2.0x in fiscal 3Q16 compared to 2.0x and 4.3x, respectively, in fiscal 3Q15.

Projections

Kate Spade made the following projections for fiscal 2016:

- net sales of $1.37 billion–$1.40 billion

- adjusted EBITDA[1. earnings before interest, tax, depreciation, and amortization] of $242 million–$260 million

- EPS of $0.63–$0.70 with the use of a normalized tax rate of 40%

- capital expenditures of $65 million–$70 million

Now, we’ll look at Apple (AAPL).